Tax Form 1098 Utility

Agencies use Tax Form 1098-MA to report to homeowners and the IRS the amount of mortgage assistance paid during the tax year.

The Form 1098 Utility allows you to create Tax Forms 1098-MA populated with application data. The utility creates a PDF copy A for the IRS, PDF copy B for the homeowner, and PDF copy C for the agency. You can also export the 1098-MA data to a Microsoft Excel spreadsheet.

The generated PDFs contain one page for each Homeowner Application with paid disbursements in the selected tax year. The following table describes the fields populated on the form. The filer information fields are populated with the same agency information for each page, while the other fields are specific to each Homeowner Application.

Field (Name in the Export File) | Description |

|---|---|

Filer's name and address | TaxFormAgencyName and TaxFormAgencyAddress configuration settings |

Calendar year (Tax Year) | Selected tax form year |

Filer's TIN | TaxFormAgencyTIN configuration setting |

Homeowner's TIN | Homeowner's Social Security Number |

Total State HFA and homeowner mortgage payments (HFA and Borrower Payments) | Sum of all Net Disbursement Amount and Borrower Contribution fields for all Disbursements with a Disbursement Status = Disbursed and a Paid Date within the year selected as the Tax Form Year |

Homeowner's name | Homeowner's First and Last Name |

State HFA mortgage assistance payments (Total Net Disbursement Amount) | Sum of all Net Disbursement Amount fields for all Disbursements with a Disbursement Status = Disbursed and a Paid Date within the year selected as the Tax Form Year |

Street address | Homeowner's Mailing Address |

Homeowner mortgage payments (Borrower Payments) | Sum of all Borrower Contribution fields for all Disbursements with a Disbursement Status = Disbursed and a Paid Date within the year selected as the Tax Form Year |

Account number (Application Number) | Application Number |

To export the raw 1098-MA data:

Navigate to the Form 1098 utility.

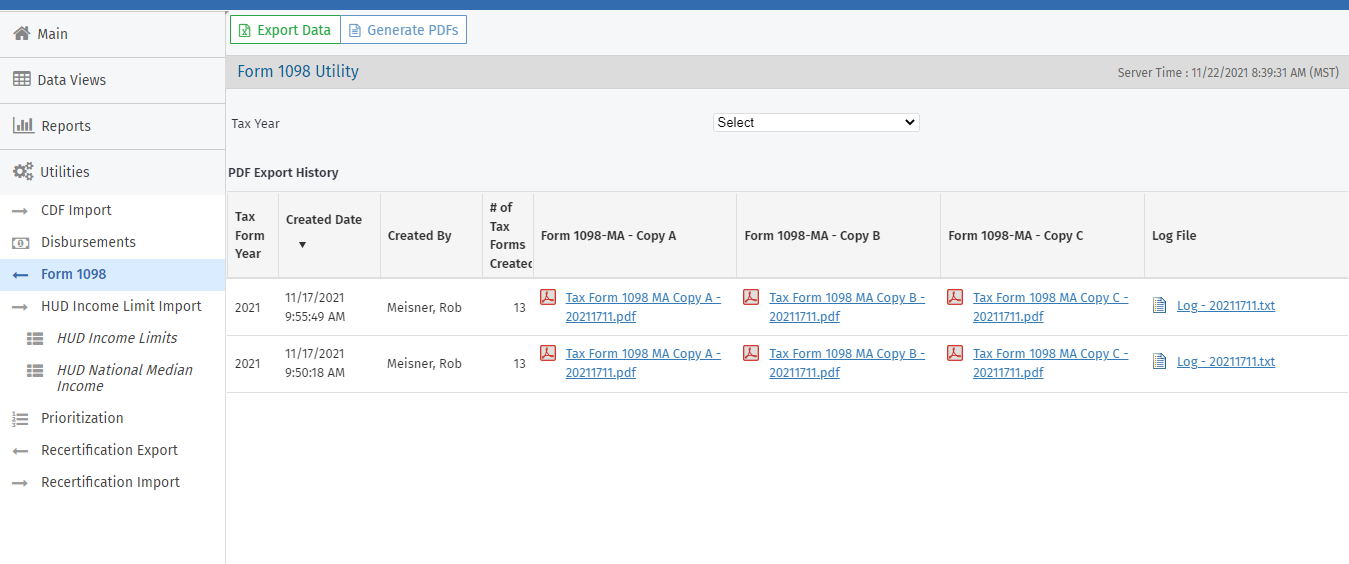

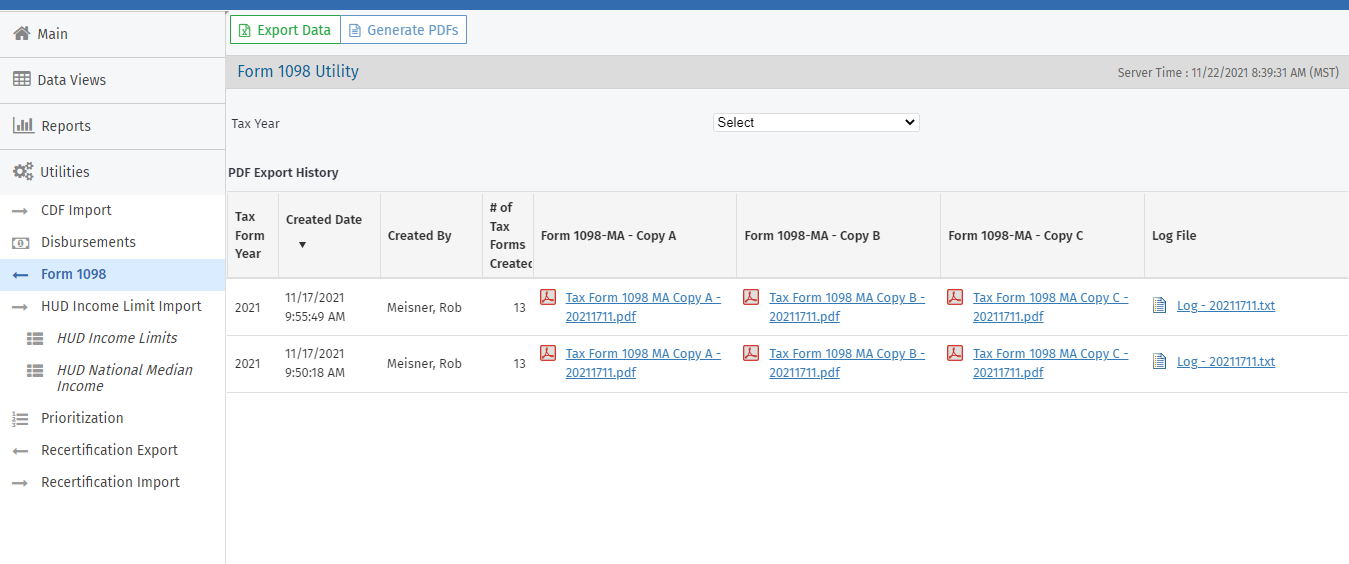

The Form 1098 Utility screen opens.

Select the Tax Year for which to generate data.

Click Export Data in the top toolbar.

The system downloads a Microsoft Excel spreadsheet populated with the following information: Tax Year, Application Number, Program Name, Program Stage, Program Status, Application Status, Stage Date, Total Net Disbursement Amount, Homeowner First and Last Name, Homeowner Social Security Number, Homeowner Mailing Address, Property Address, Co-Borrower First and Last Name, Co-Borrower Mailing Address, Co-Borrower Social Security Number, HFA and Borrower Payments, Borrower Payments.

To create PDFs of the tax forms 1098-MA:

Navigate to the Form 1098 utility.

The Form 1098 Utility screen opens.

Select the Tax Year for which to generate data.

Click Generate PDFs in the top toolbar.

The system generates a PDF for each version (Copy A, Copy B, and Copy C), which you can download from the PDF Export History grid. Each PDF contains one page for each Homeowner Application with paid disbursements in the selected tax year.

If the Homeowner Application does not have a social security number, first name, or last name for the homeowner; if the Homeowner Application has an incomplete property address; or if the ProLink Admin configuration settings for the Tax Form Agency are empty, then the system creates a log file.