What's New

The release introduces new functionality in the following categories:

Homeowner Portal Enhancements

The release includes the following enhancements in the Homeowner Portal.

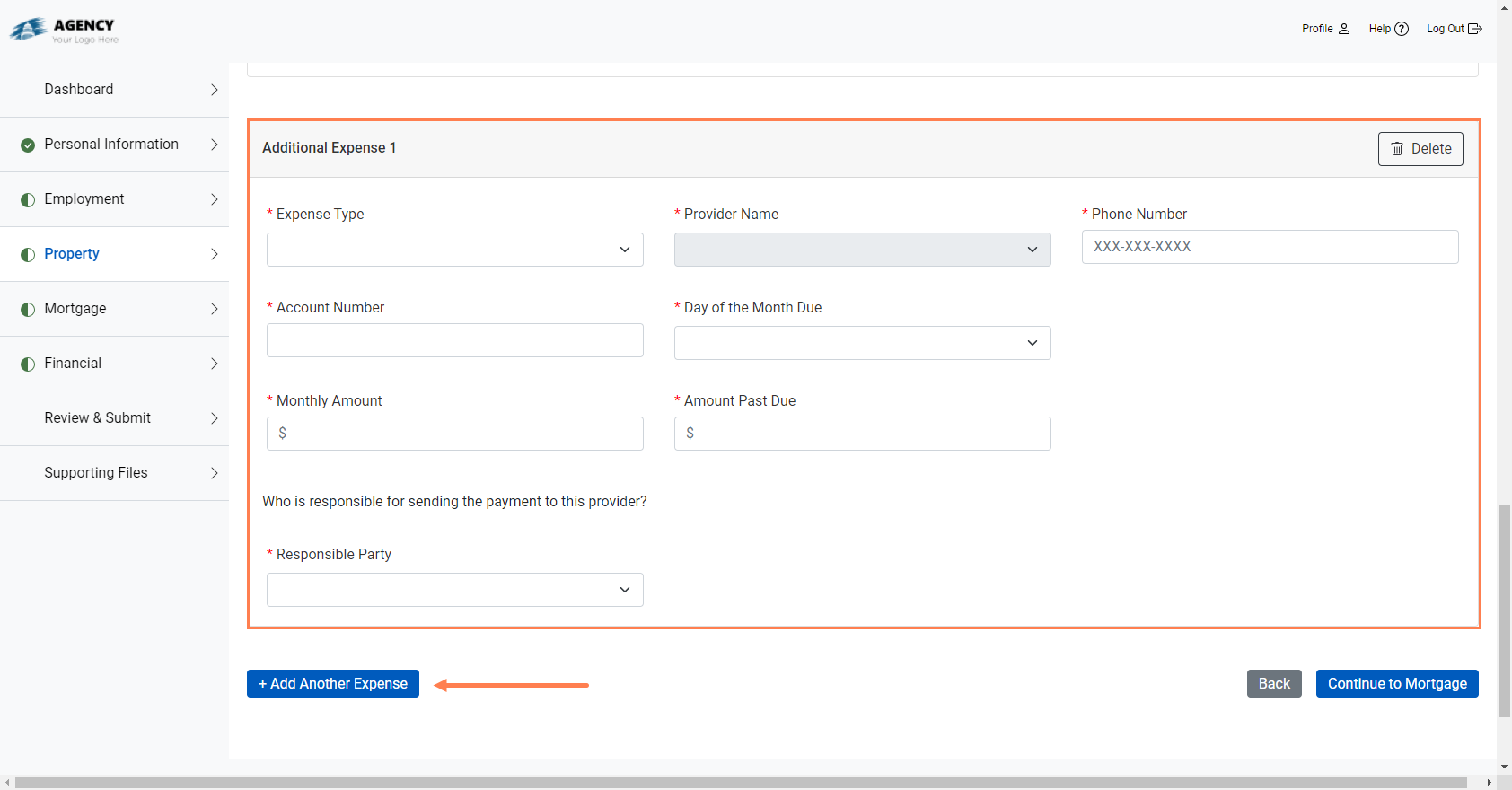

Preparation for Support of Eligible Expenses

The Property screen allows applicants to enter eligible expenses. The availability of each expense type is controlled by a front-end configuration.

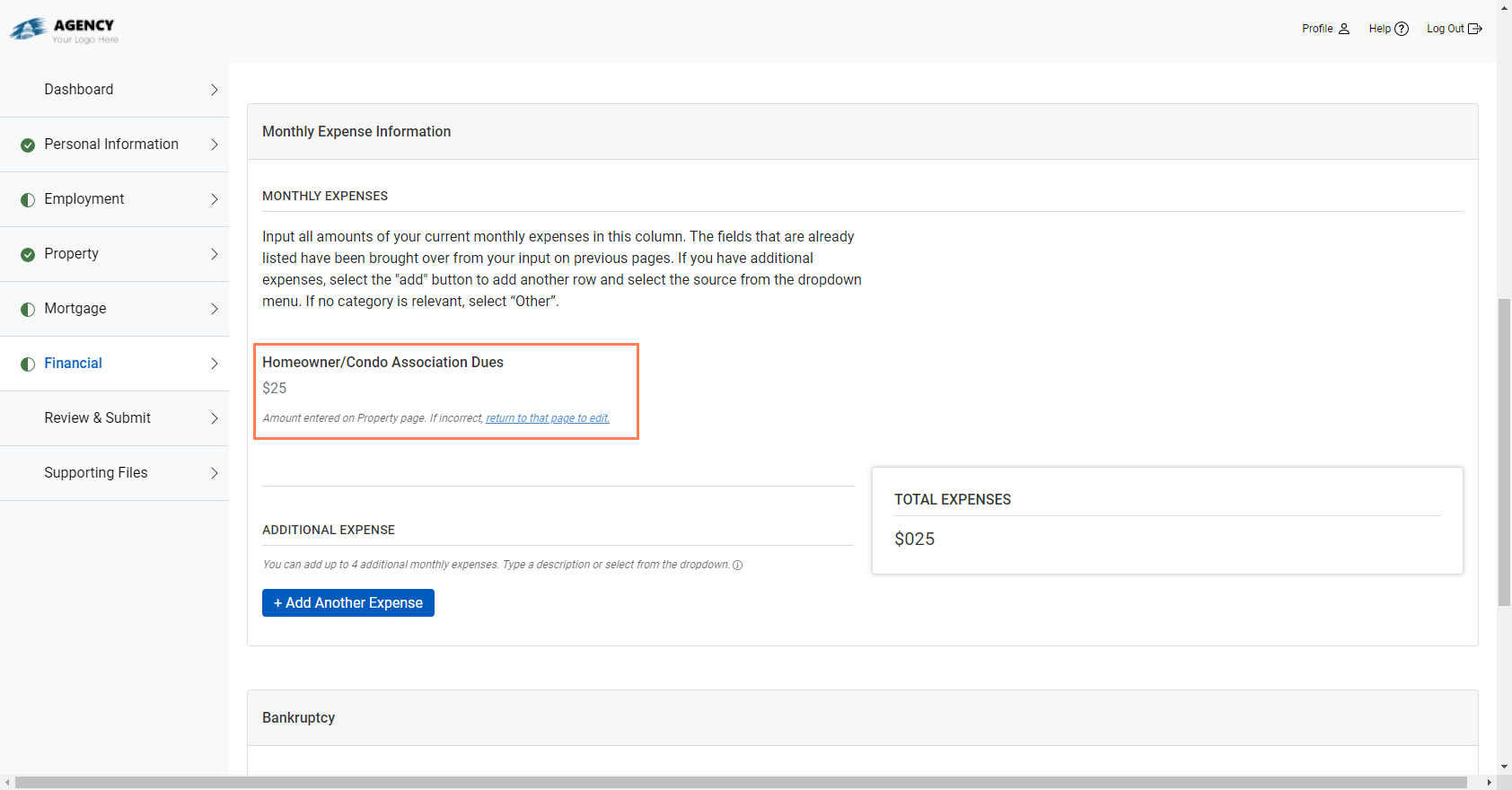

The Financial screen displays read-only summary information about the eligible expenses entered on the Property screen. These expenses also contribute to the totals on the screen.

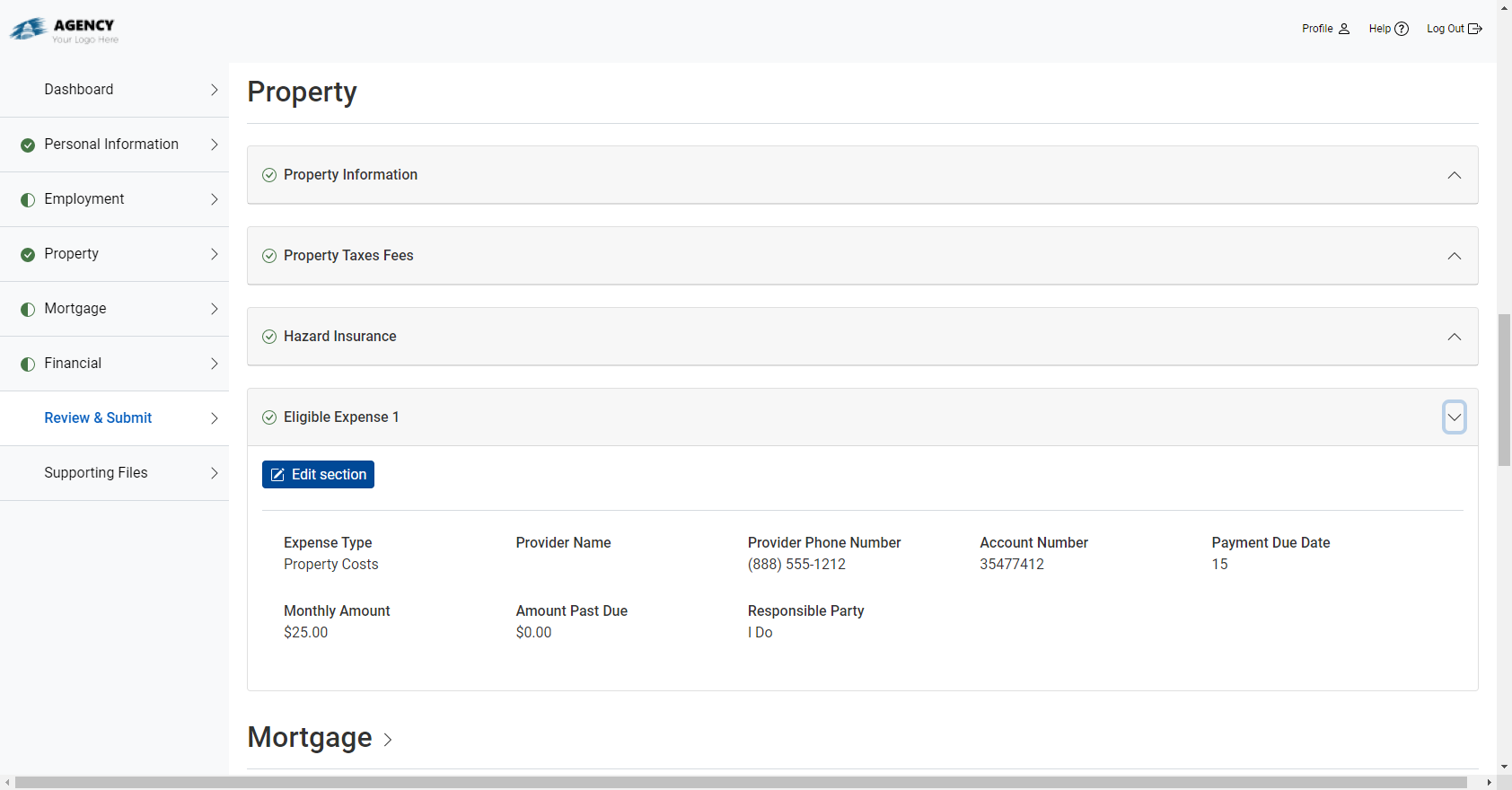

The Review & Submit screen also shows the eligible expense information entered by the applicant.

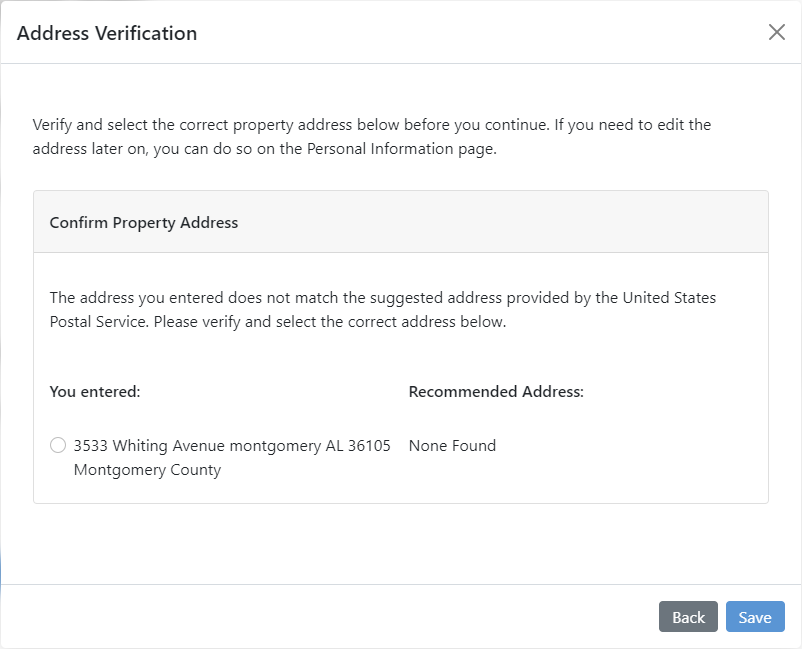

Property Address Validation

Important

While included in this code release, this feature is turned off by default.

The Homeowner Portal now includes address validation. Whenever the applicant navigates away from the Personal Information screen, after entering property address information, a popup opens to confirm the preferred USPS address formatting.

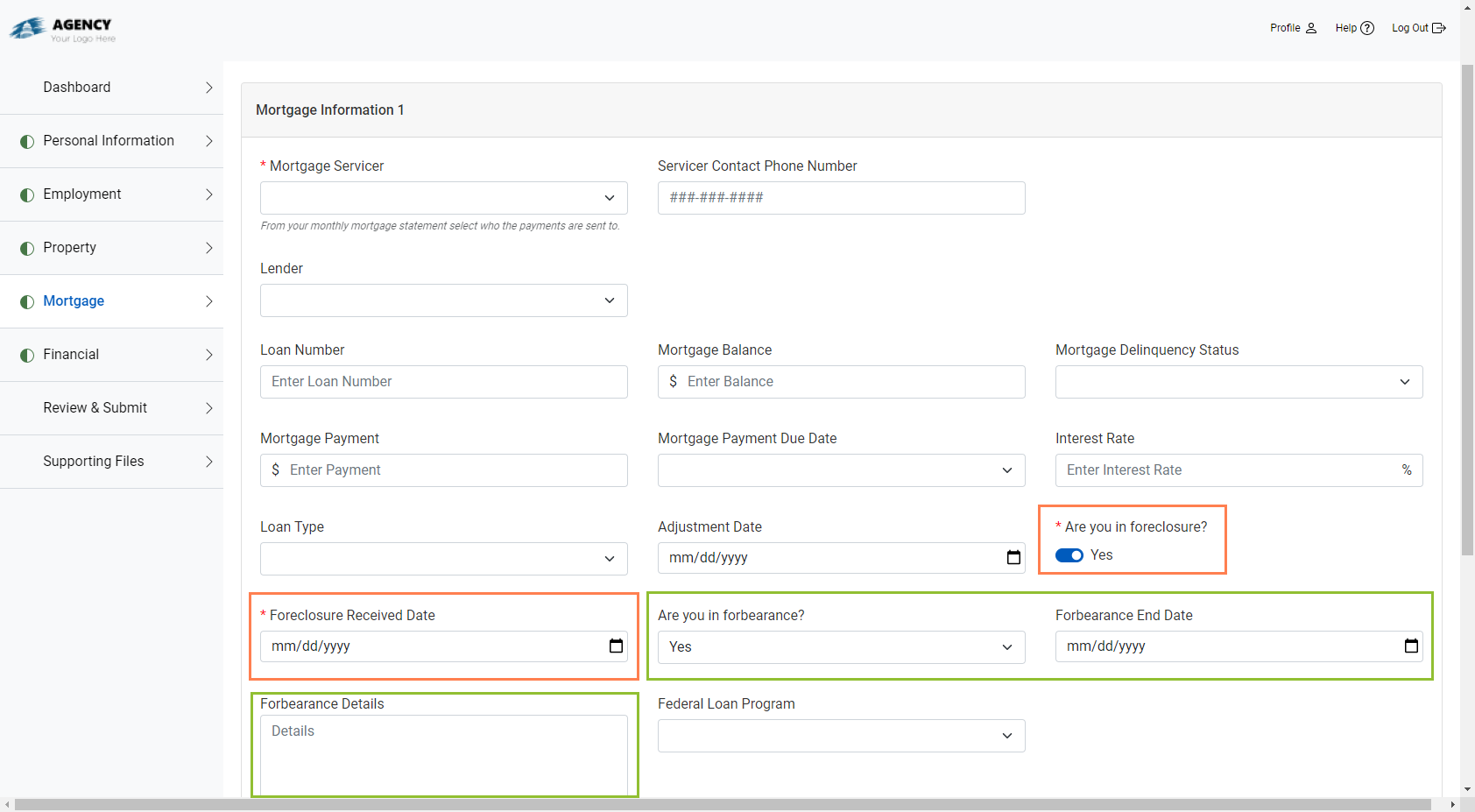

Mortgage Updates

The Mortgage screen now includes fields for foreclosure and forbearance:

Are you in foreclosure

Foreclosure Received Date (available if Are you in foreclosure = Yes)

Are you in forbearance

Forbearance End Date (available if Are you in forbearance = Yes)

Forbearance Details (available if Are you in forbearance = Yes)

Other Updates

The secondary phone information on the Personal Information screen is hidden unless the applicant specifically chooses to add a secondary number.

Also on the Personal Information screen, the Socially Disadvantaged question can be hidden through a front-end configuration if your Agency does not want applicants to see or answer the question.

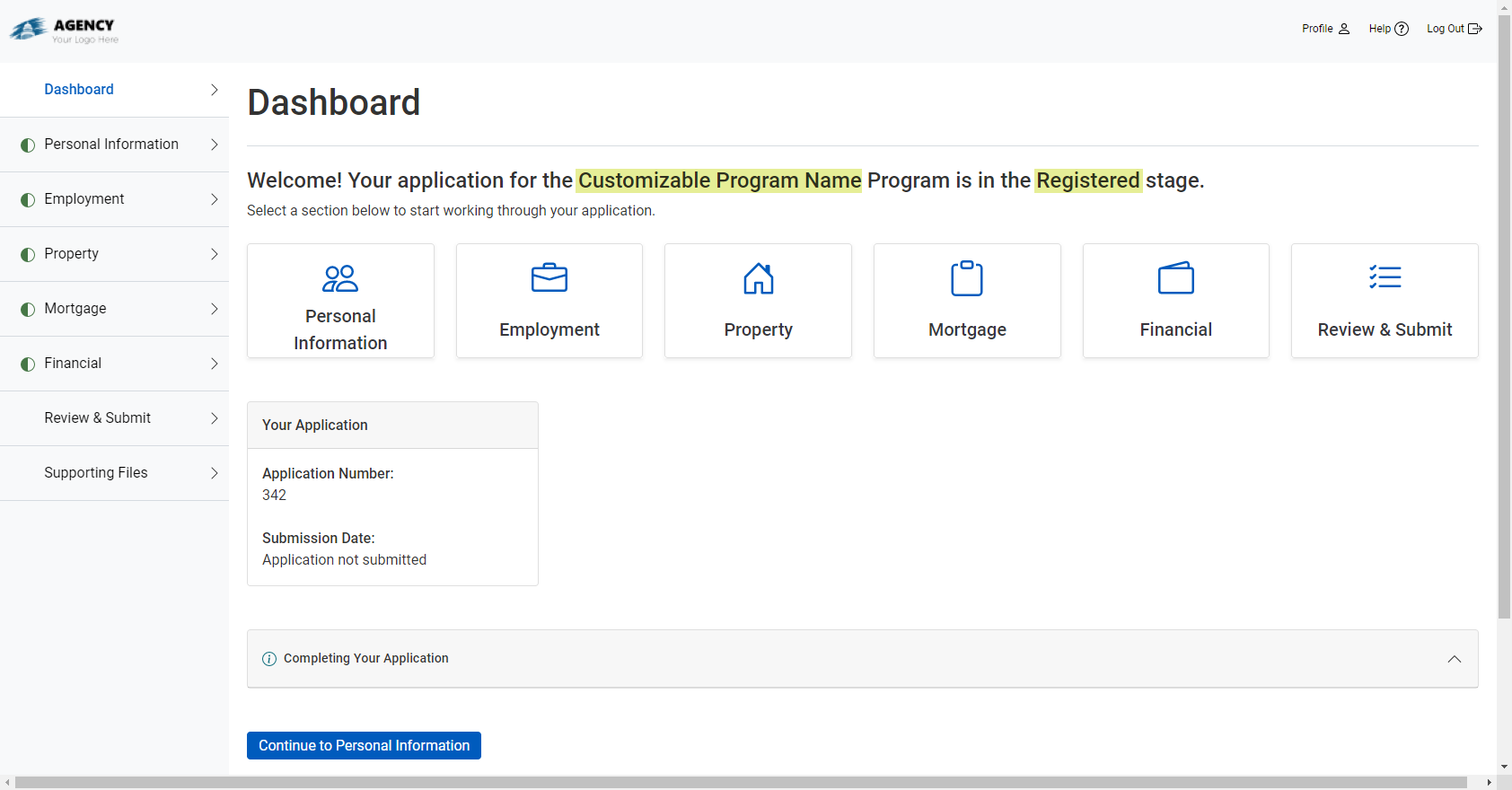

The Dashboard title shows the Program Stage Description as the application progresses through the stages. Work with your implementation Principal Business Consultant to make sure the Program Name in the title is configured as expected for your Agency.

Agency Portal Enhancements

The release includes the following enhancements in the Agency Portal.

Refinement of the Most Favorable Median Income %

The Pre-Qualification question about total annual income from all sources uses the applicant-answered county and total number of persons in household to help determine the value shown in the question. The system determines the value as 150% of AMI (based on the HUD Income Limits median income for the county and number of household persons). Going forward, if the UseMostFavorableMedianIncome configuration setting is TRUE, then the system will also look at NMI (based on the HUD National Income Limits) and use whichever value—AMI or NMI—is more favorable.

Application Prioritization

ProLink has made changes to assist Agencies with prioritization of homeowner applications.

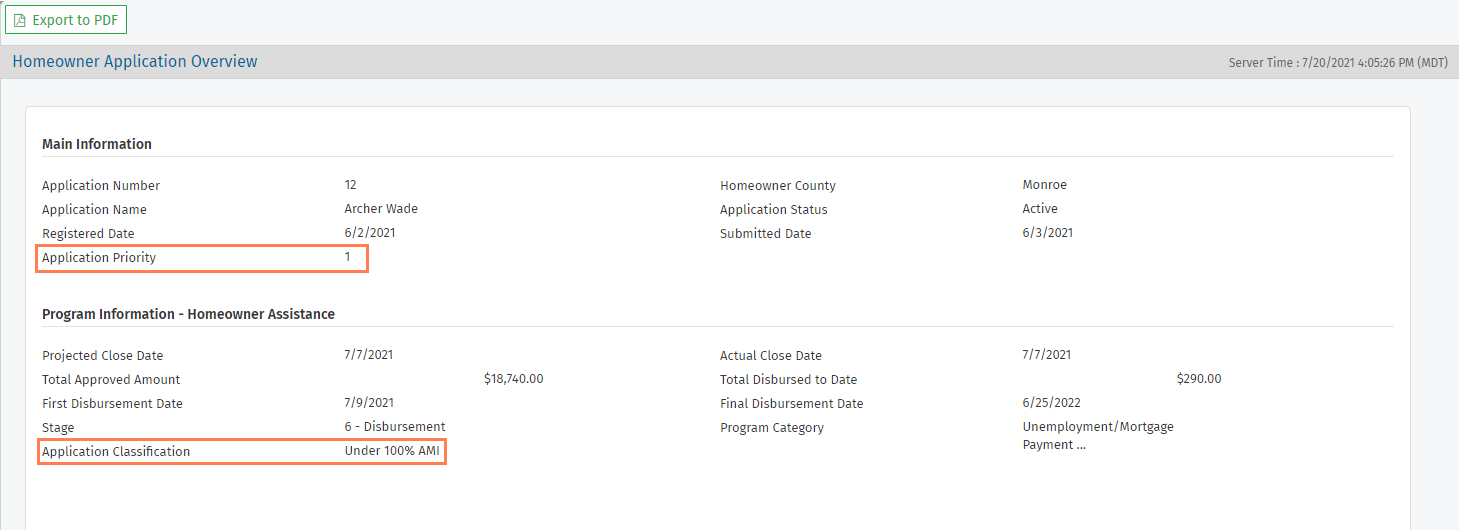

The Homeowner Application Overview screen now includes read-only fields to show the Application Priority (see the 21.3.3 Release Notes for the introduction of this field) and Application Classification.

ProLink added two new fields to the database:

Applicant Most Favorable Median Income %—Calculated field that shows the lesser of the Applicant AMI % and Applicant NMI %.

Underwriter Most Favorable Median Income %—Calculated field that shows the lesser of the Underwriter AMI % and Underwriter NMI %.

These fields are available in the Homeowner Applications and Program Qualifications data views.

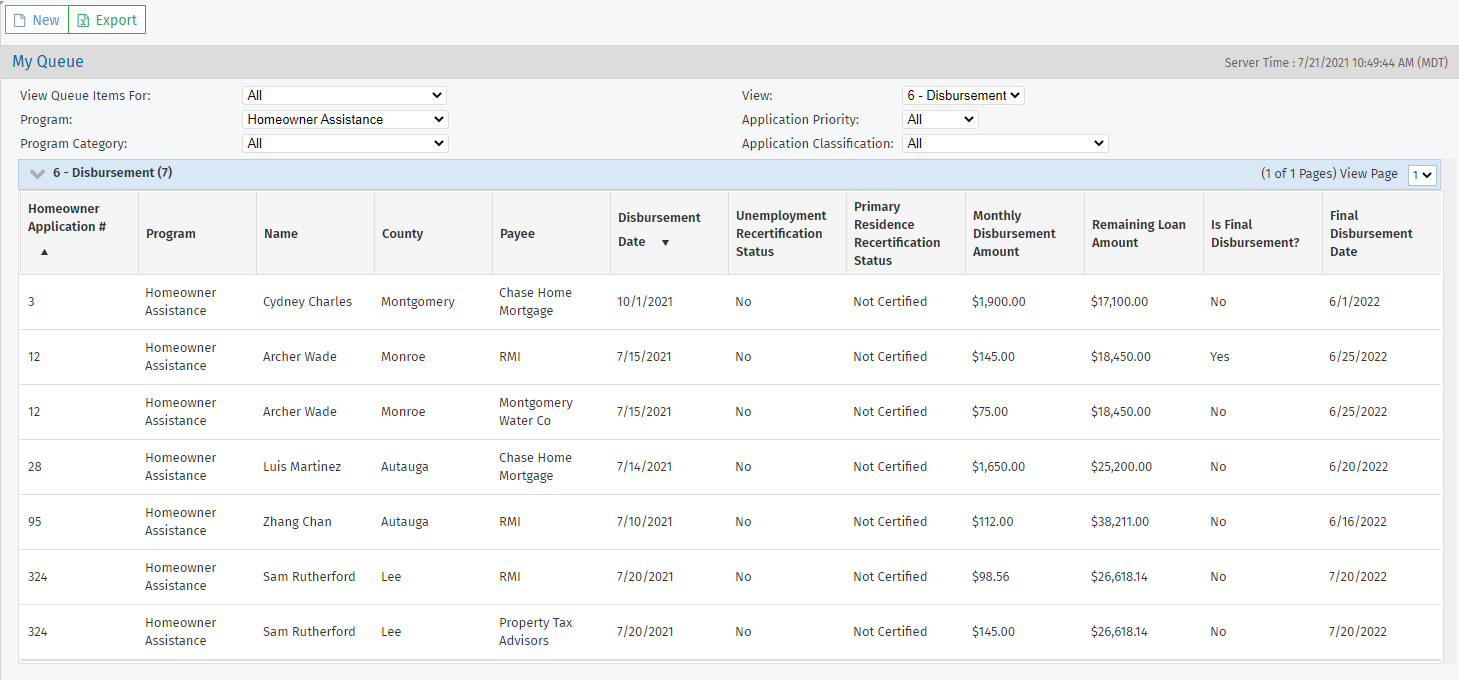

As part of the prioritization changes, ProLink has updated the My Queue screen. The screen now includes the Application Priority field as a filter and column in the grids, while the Federal Loan Program field has been removed.

In addition, default sorting on the My Queue grids has been updated as follows:

Stage 1 - Registered—Sort by Registered Date descending

Stage 2 - Submitted—Sort by Submitted Date descending

Stage 3 - Qualification—Sort by Priority descending

Stage 4 - Underwriting—Sort by Priority descending

Stage 5 - Closing—Sort by Priority descending

If you change the grid sorting, your selection is remembered on subsequent visits to the screen.

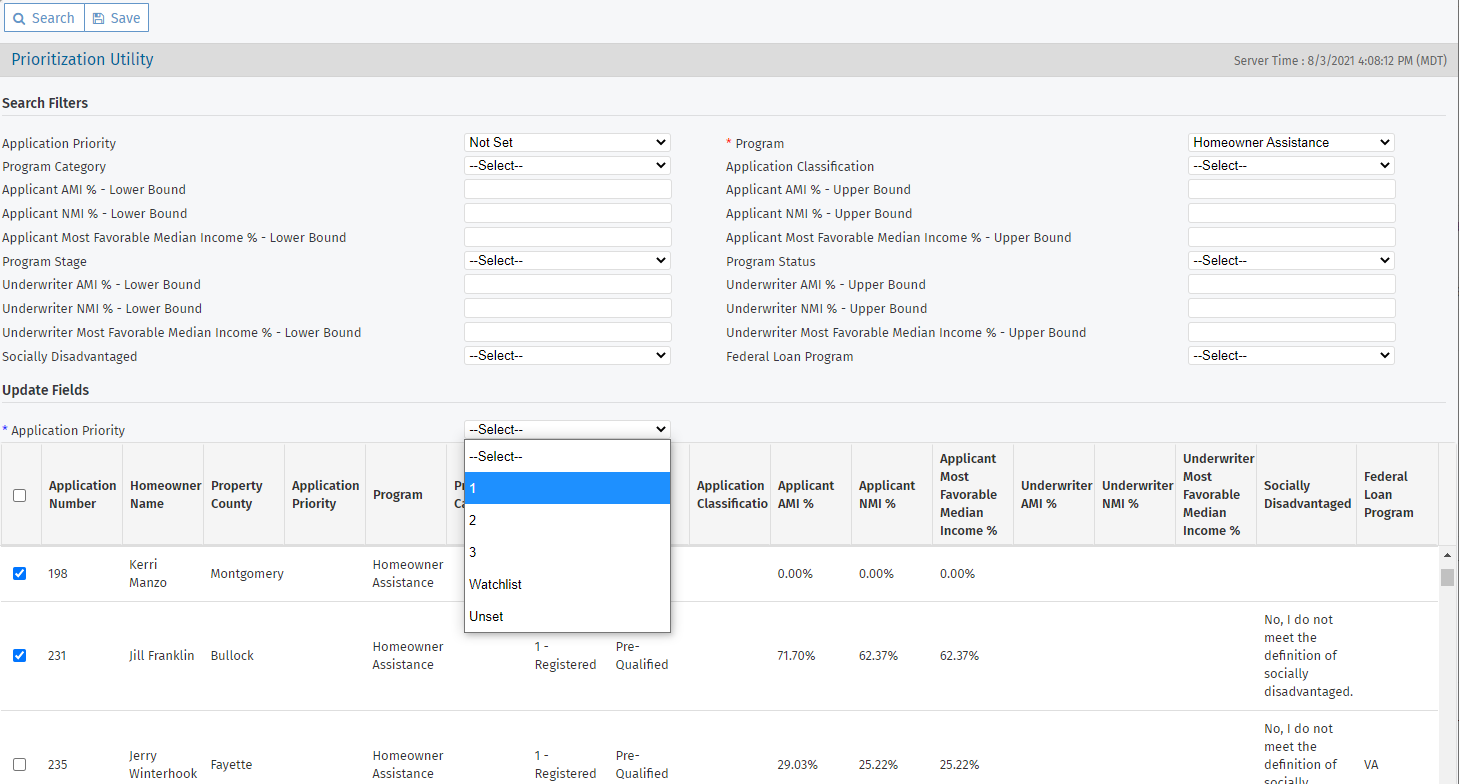

ProLink+ Utilities includes a new Prioritization utility, which helps you prioritize applications according to the needs of the agency's plan.

You can search for applications, filtering on the following parameters:

Application Priority

Program—Required

Program Category

Application Classification

Applicant AMI%

Applicant NMI%

Applicant Most Favorable Median Income%

Underwriter AMI%

Underwriter NMI%

Underwriter Most Favorable Median Income %

Socially Disadvantaged

Federal Loan Program

After you have identified a group of applications, you can set or change the Application Priority for all the selected applications at one time.

Preparation for Support of Eligible Expenses

Important

The visibility of the Agency Portal changes described below is dependent on system settings, configuration settings, and security privileges.

The Application PDF that is saved to the Supporting Files in the Homeowner Portal and available for export from the Homeowner Application Overview screen in the Agency Portal now includes an Expense Information section, which provides information on each expense added to the application.

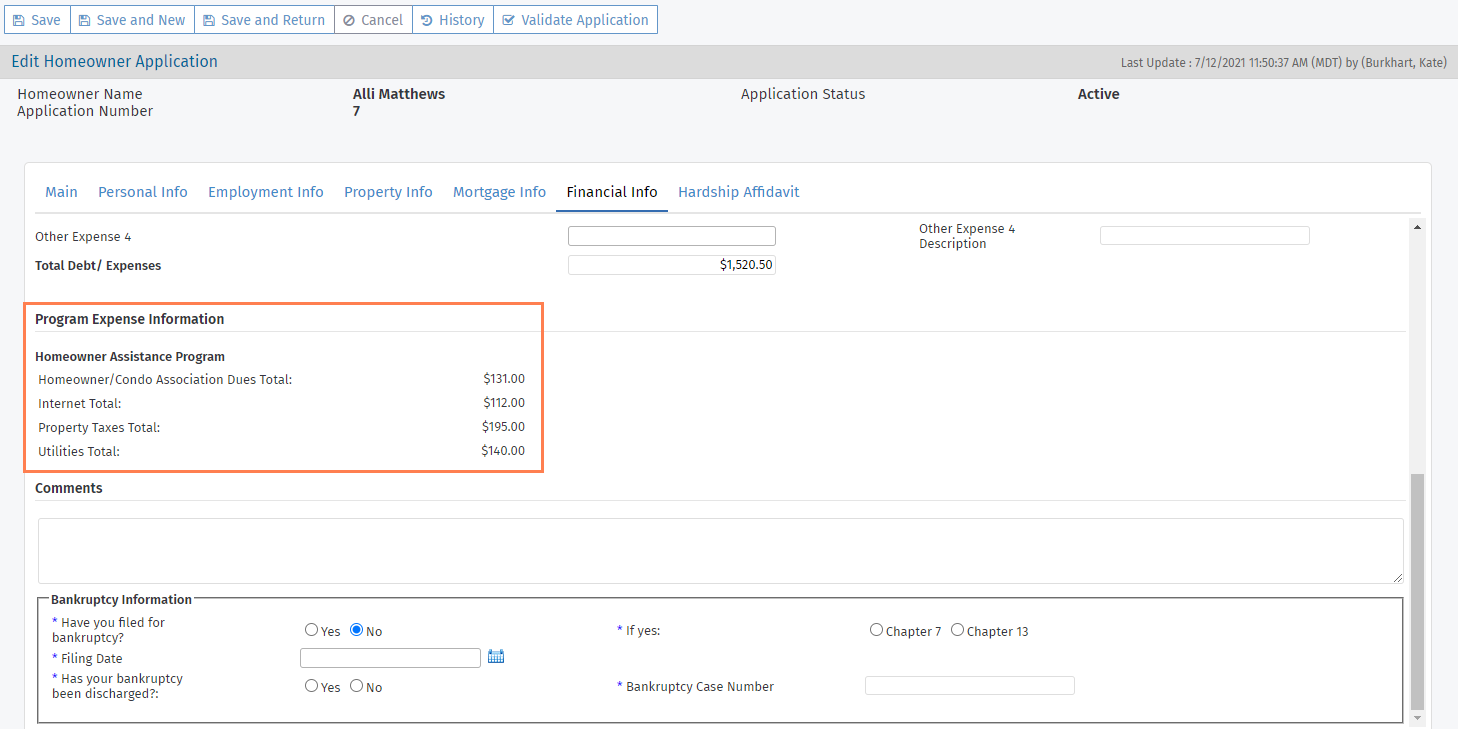

The Edit Homeowner Application - Financial Info screen includes a new section called Program Expense Information that sums all expenses on the program for each expense category on the application.

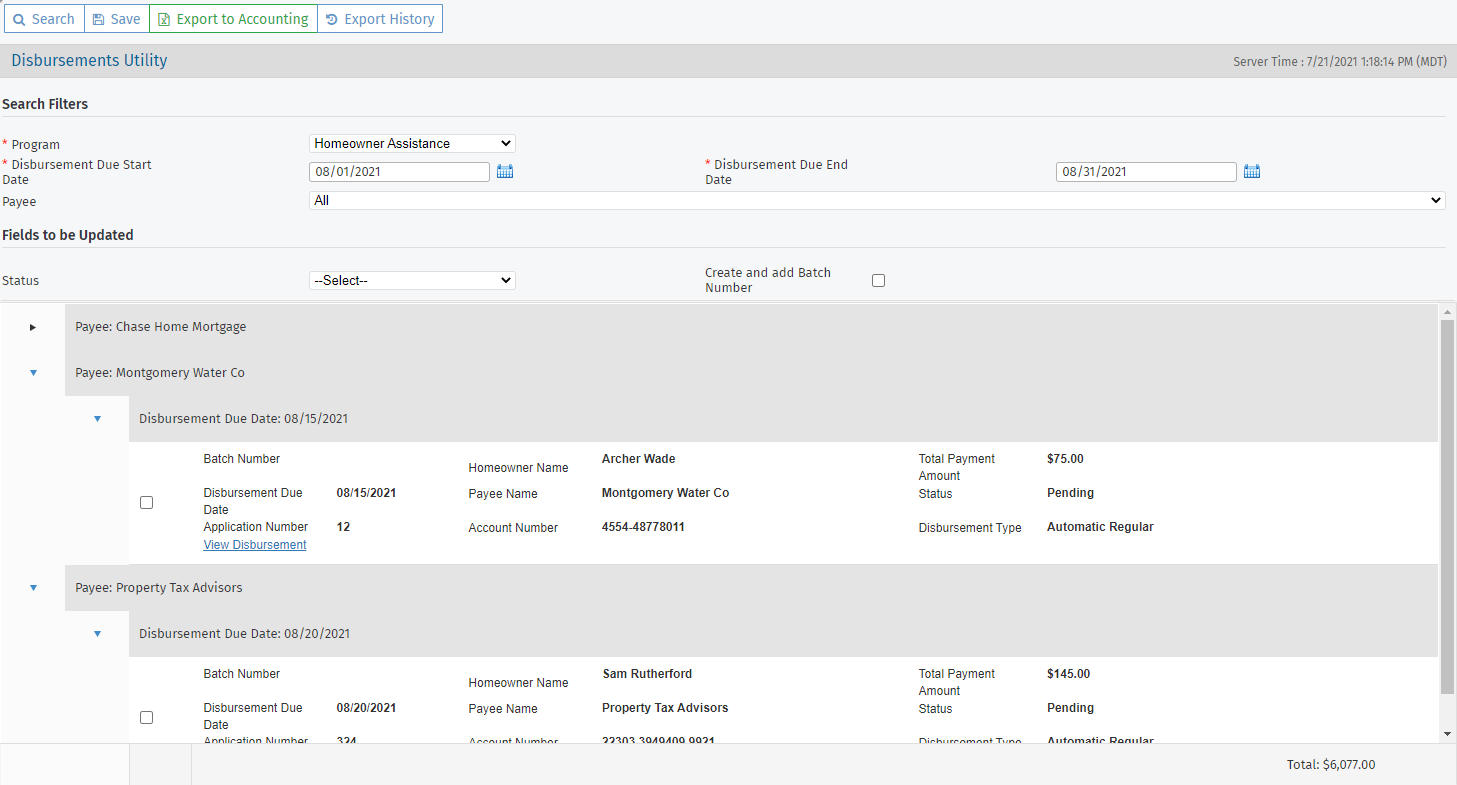

We have also updated the Disbursements utility to accommodate expense payees in addition to mortgage payees. The search results include disbursements paying out to either mortgage servicers or Expense Category entities.

All "Servicer" columns in the Disbursements export file have been changed to "Payee." In addition, Borrower Name is now "Homeowner Name" and "Borrower Loan Number" is now "Account Number" in both the Excel file and in the utility's grid.

The method to view specific disbursements from the utility has been updated. Rather than clicking the row, you can now click the View Disbursement link to open the Edit Disbursement screen in a new tab.

Lastly, the Program Stage requirements for Stage 6 - Disbursement are updated so that at least one eligible expense or mortgage has a disbursement scheduled.

Common Data File (CDF) Updates

ProLink has updated CDF functionality so that all CDF records can be associated with an application. In addition to V records, the CDF Import utility can now import other "servicer to state" record types (C, E, F, O, P, R, S, W, Y). The screen labels for the utility are now generic and no longer specific to V records.

All imported records for an application will be included in the CDF Records data view and on the CDF Records screen. Click the row of an imported record to open the corresponding CDF Record Data screen.

The Current CDF Data screen for a selected application continues to show the most recently imported V record.

For generated CDFs, the Excel files contain header information, including the CDF version information.

Qualification Updates

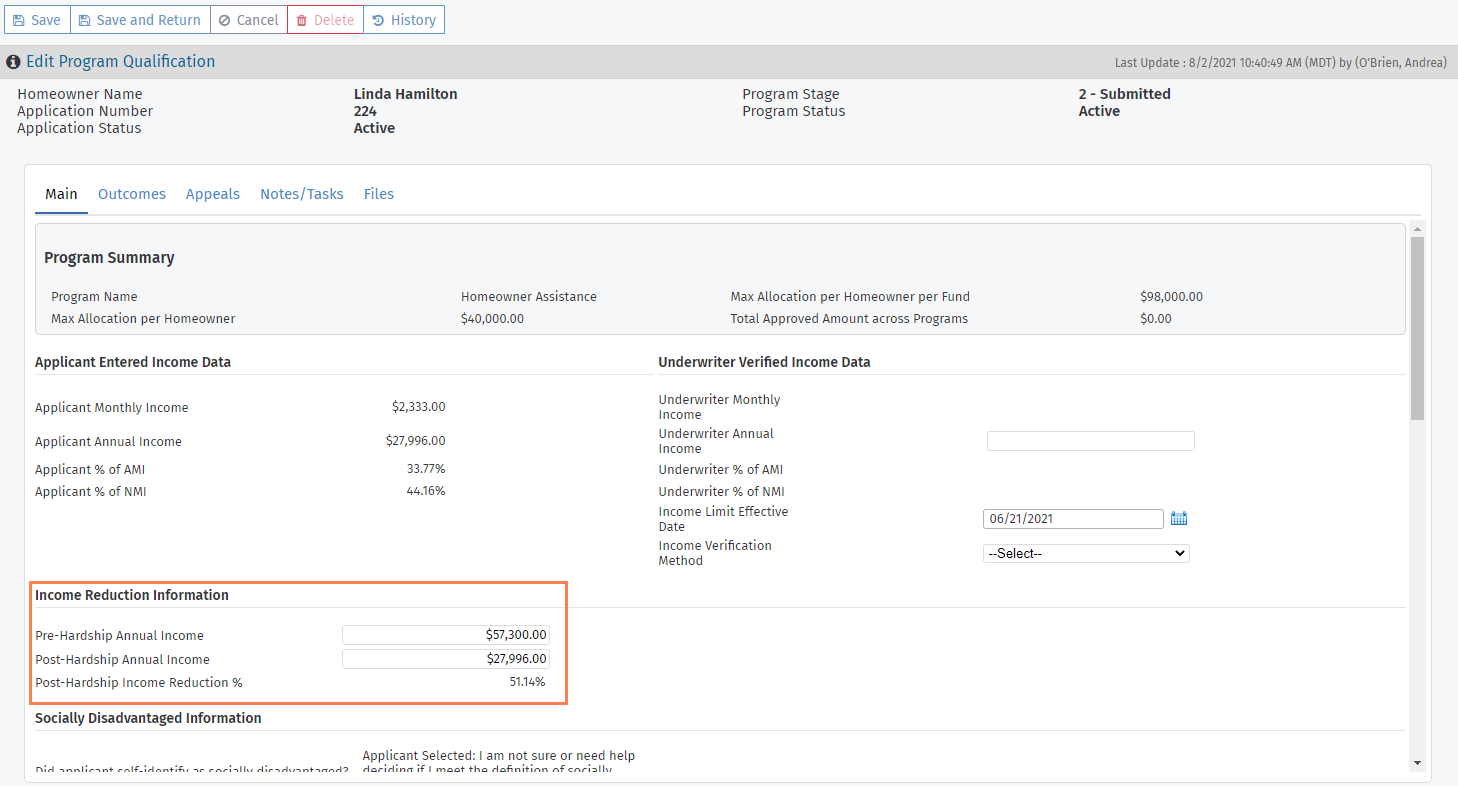

The Edit Program Qualification screen includes a new section called Income Reduction Information to capture pre/post-hardship income information. The section includes the following new fields:

Pre-Hardship Annual Income

Post-Hardship Annual Income

Post-Hardship Income Reduction %—Calculated on save to show (Pre-Hardship Annual Income - Post-Hardship Annual Income) / Pre-Hardship Annual Income * 100

These fields are also included in the Program Qualifications data view.

Application PDF Updates

ProLink has updated the application PDF that is generated when the application is submitted. These changes ensure the application PDF includes the appropriate application data and field labels.

Admin Updates

The Homeowner Income Sources picklist is now a non-system picklist that the Agency system administrator can edit and maintain.

ProLink Admin includes a new non-system picklist called Additional Expense Category.

As part of the Income Reduction Information changes described earlier, the ProLink Admin Edit Program screen includes a new section called Income Settings to manage these settings at the program level. When you select the Enable Income Reduction checkbox, the Income Reduction Information section is included on the Edit Program Qualification screen.

The Entities data view includes a Counties Served column, which shows a list of the counties selected on the Edit Entity - Counties Served tab.

ProLink Config Settings includes seven new configuration settings that allow text to be appended to the automated stage-change emails when an application changes stage (between stage 2 through 8) and has an Active status. The setting value can be populated with up to 4000 characters.

ProLink also introduces a configuration setting in the Agency Portal that allows you to control whether the Socially Disadvantaged question is required to submit an application.