What's New

The release introduces new functionality in the following categories:

Homeowner Portal Enhancements

The release includes the following enhancements in the Homeowner Portal.

General and Login Changes

If the Agency or Agency partners create an application in the Agency Portal and use Manage Portal Account to invite the applicant to the Homeowner Portal, the applicant will be required to change their password when they first log in using the temporary, system-generated password.

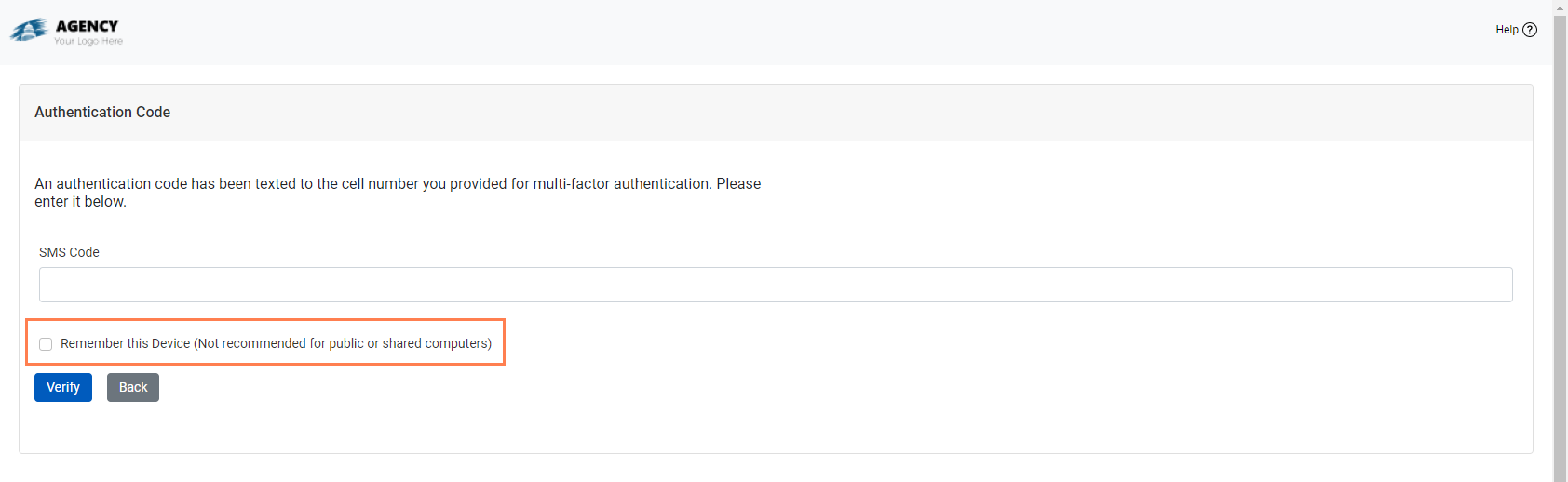

The Homeowner Portal includes changes that result in an improved login experience for the applicant. The applicant can select the Remember this Device checkbox so that they do not have to complete the multi-factor authentication with every login.

To help ensure homeowner applicants have a favorable experience completing their application online, the Homeowner Portal now shows a banner recommending a browser upgrade if the applicant is using an old, unsupported browser.

From the My Profile screen, the applicant can view and edit their profile information. ProLink has implemented validation to prevent the applicant from saving an email address change if the email address already exists in the system.

ProLink added validation in the Agency Portal when back-office users save submitted applications with a social security number (SSN) that already exists in the system for any application—for homeowner, co-borrower, or spouse. In addition, validation occurs for submitted applications if the loan number on any of the mortgages is the same as another mortgage for the same servicer entity on any application. At this point (Stage 2 - Submitted), the applicant cannot make changes to their application in the Homeowner Portal. If the SSN, loan number, or other information needs to be corrected, you need to make the changes in the Agency Portal.

Review and Submit Section Changes

ProLink+ includes a config setting (Agency Portal) that allows the Agency to enable or disable the DocuSign functionality. When the setting is enabled, the applicant (and co-borrower and spouse if applicable) will sign the Hardship Affidavit electronically using DocuSign. When the setting is disabled, the Agency will deliver any necessary paperwork for the applicant to review. Then the applicant will enter their name and date in the corresponding fields in the Homeowner Portal. By filling in their name and date, they effectively sign the Hardship Affidavit electronically. The Agency can also populate the name and date fields through the Agency Portal.

For the rare scenario where DocuSign is enabled but the applicant signs a physical copy of the Hardship Affidavit, when the Agency populates the name and date fields in the Agency Portal, the Homeowner Portal displays that signature name and date.

Supporting Files Changes

When an application moves to Stage 2 - Submitted, a copy of the signed (DocuSign) Hardship Affidavit is saved to the Supporting Files screen in the Homeowner Portal. The same file is saved to the Files screen on the application in the Agency Portal.

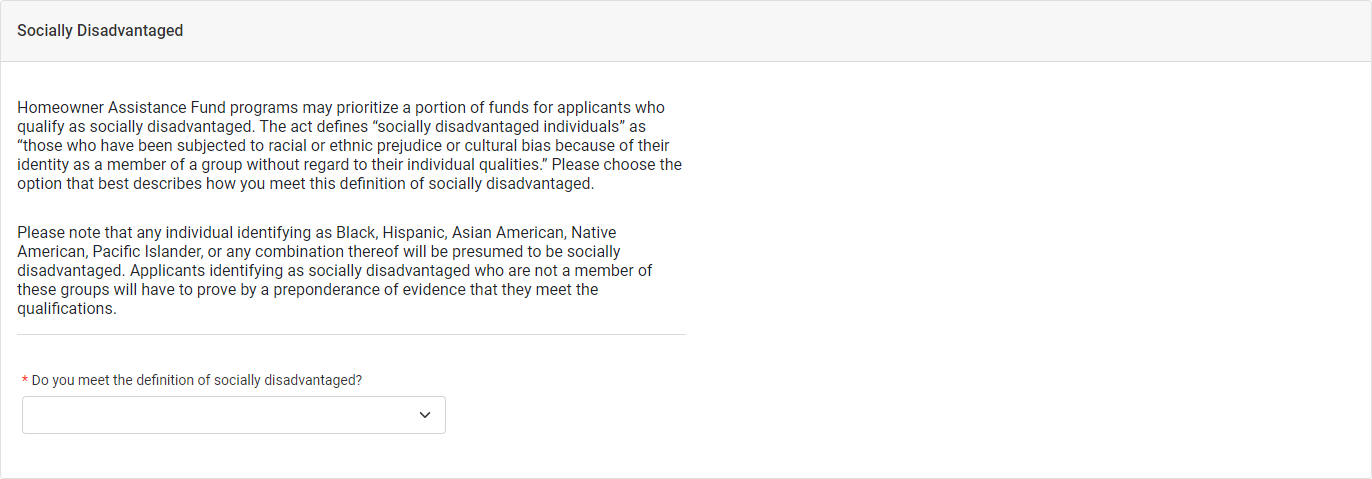

Admin Changes

Agencies can customize content on a number of the Homeowner Portal screens. With this release, the Socially Disadvantaged text can be unique per Agency. During implementation, work with your assigned Principal Business Consultant to configure the Socially Disadvantaged text to meet the needs of your Agency.

If the system admin or Program Manager has inactivated picklist values in ProLink Admin (Agency Portal), then the applicant will no longer see those values in the corresponding drop-down lists in the Homeowner Portal.

Lastly, the system admin or Program Manager can indicate new applications (registrations) are not being accepted for a program. A homeowner applicant attempting to create a new profile will see only the program(s) that are accepting applications. If no programs are accepting applications, the sign up link will be hidden.

Agency Portal Enhancements

The release includes the following enhancements in the Agency Portal.

Application Prioritization

ProLink has made changes to assist Agencies with prioritization of homeowner applications.

A new, optional Application Priority field is located on the Edit Homeowner Application - Main tab. The default values represent numeric sort order 1–3 plus "Waitlist." The field is a non-system picklist, so the Agency's system administrator can change the values if needed. In addition, the field is added as an available column in the following data views: Homeowner Application, Program Qualification, Program Stages, Disbursements, Loans, and Checklist Items.

Preparation for Support of Eligible Expenses

Important

While changes to support eligible expenses have been completed in the Agency Portal as described below, the functionality will not be ready to use until additional changes in the Homeowner Portal are done (future release).

The visibility of the Agency Portal changes described below is dependent on system settings, configuration settings, and security privileges.

ProLink+ includes a number of changes to support tracking an applicant's expenses as well as disbursing funds to entities for various types of expenses the homeowner may need reimbursed.

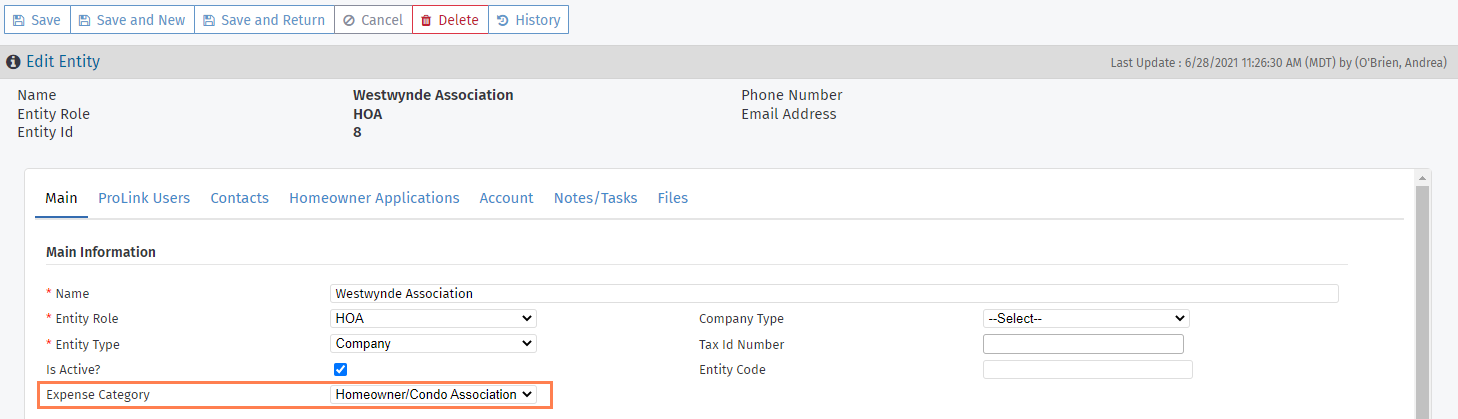

On Edit Entity, you can now select the Expense Category (system picklist) the entity is associated with, so that when you or the applicant creates an expense record in the system, the record is associated to a specific expense category and you choose from the expense entities in that category. The field is added as an available column in the Entities data view.

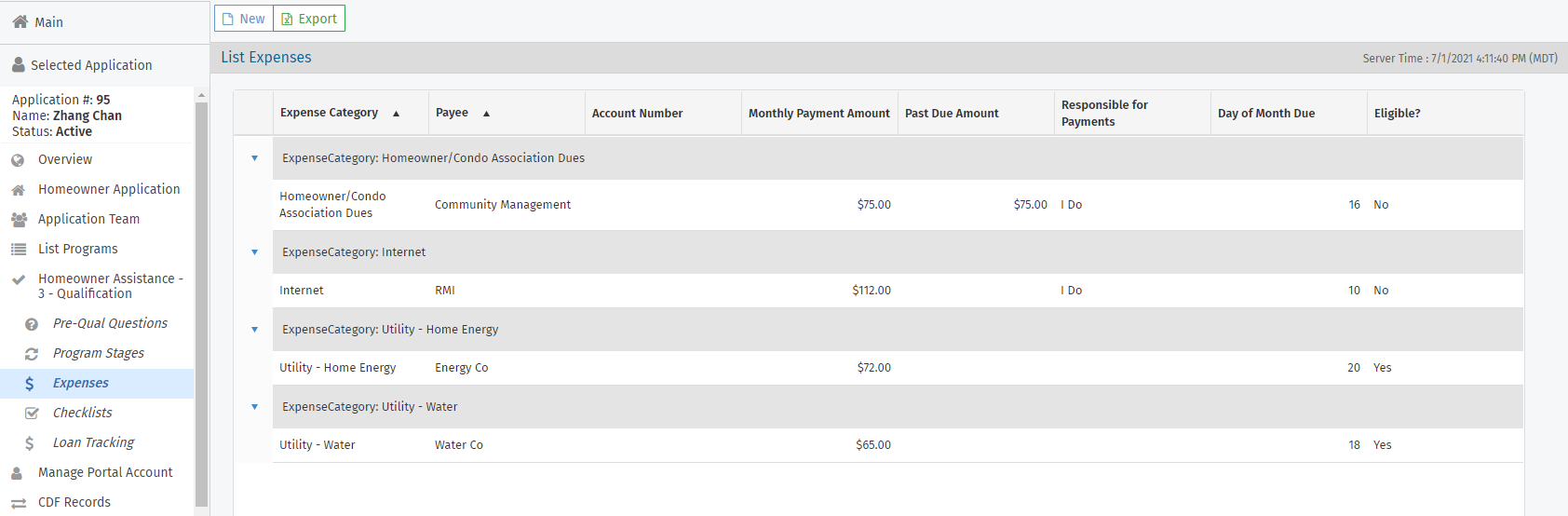

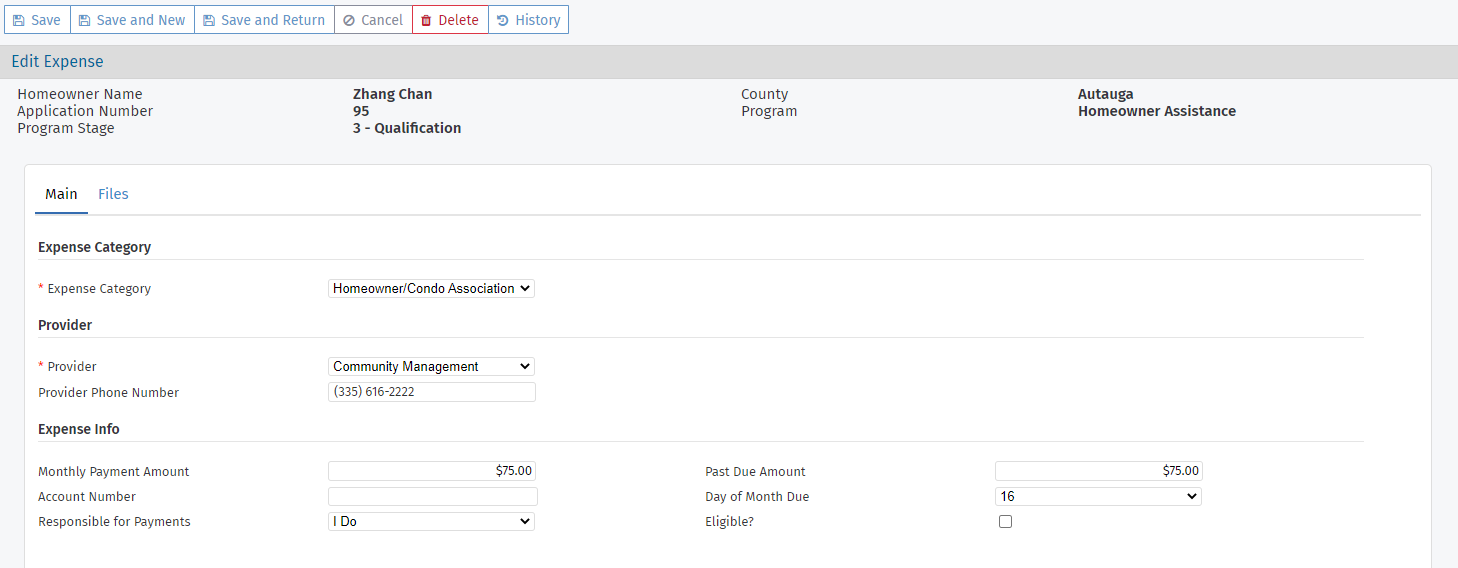

The selected Application panel includes a new menu option under the Program Stages option, called Expenses. When you select this option, the List Expenses screen opens. Clicking a row in the grid opens the Edit Expense screen. These expense records will correspond to expenses that the applicant enters in the Homeowner Portal (future release).

Note

If you indicate the expense is Eligible, then you must select an actual expense entity for the Provider. That is, you cannot select "Other," which serves as a placeholder.

List Expenses screen; Edit Expense screen

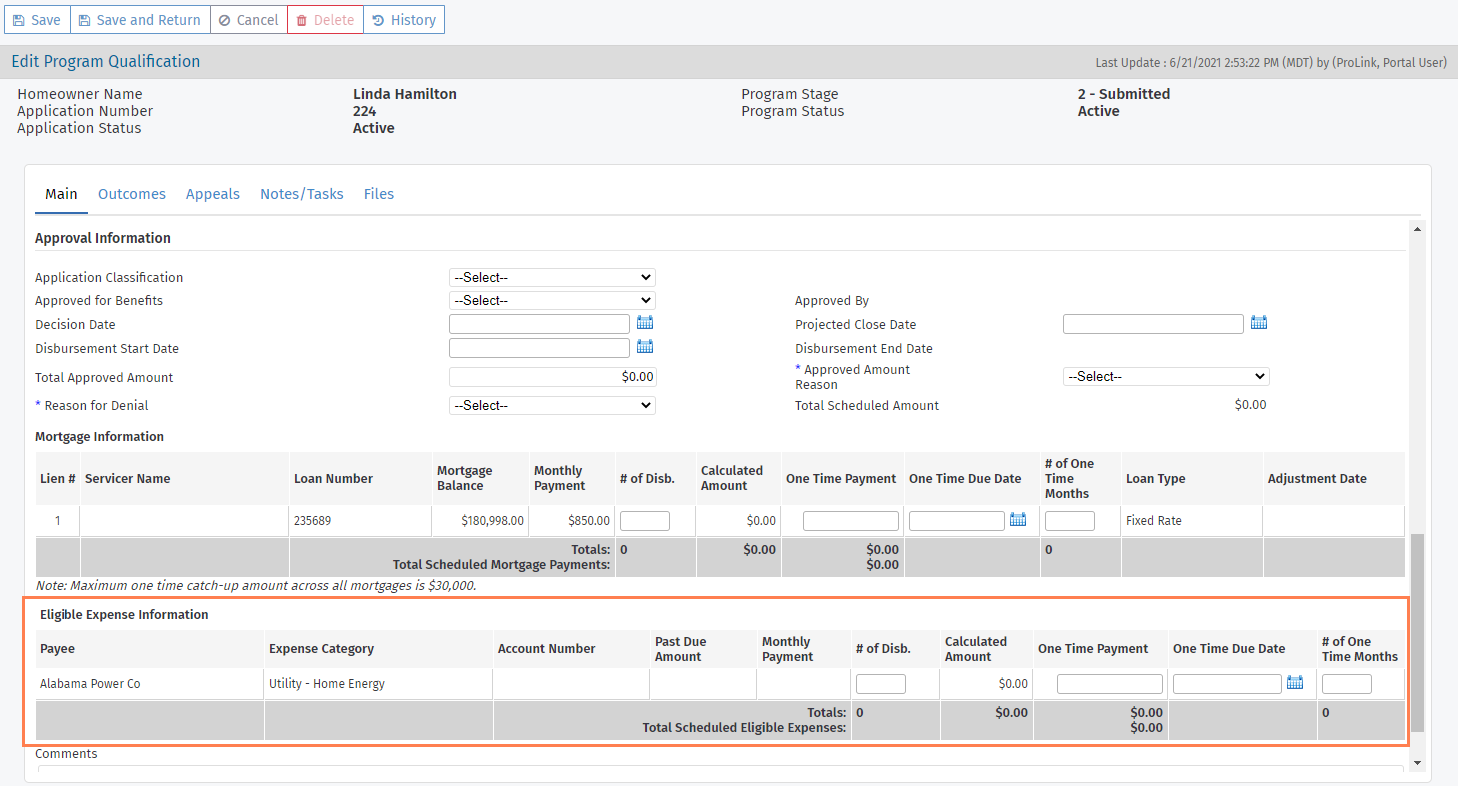

The Edit Program Qualification screen includes a new Eligible Expense Information section where the eligible expenses are listed. The Processor/Underwriter will enter approved benefit payments for these expenses.

When you advance a program to Stage 6 - Disbursement, the system creates the Disbursement records for scheduled mortgage payments. For programs set up to allow eligible expenses, the system will now create Disbursement records for eligible expenses scheduled through the Edit Program Qualification screen.

On the Edit Disbursements screen, you can now select any entity that is a mortgage servicer entity or expense entity on the Homeowner Application.

The Data Views panel includes a new Expenses data view so that you can search and report on expenses throughout the system. The Disbursements data view includes data for all payees—mortgage servicers as well as expense entities.

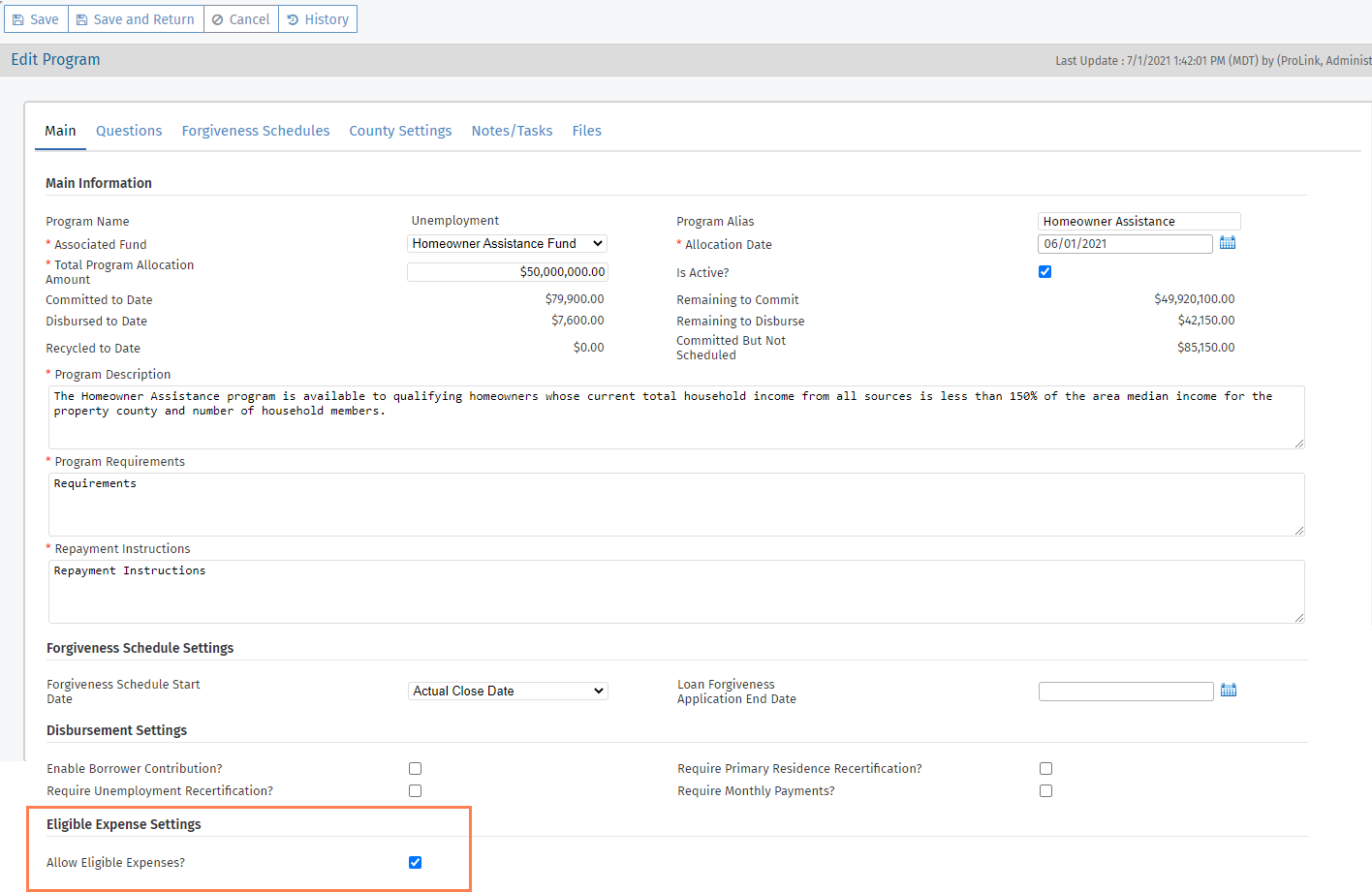

Admin Changes

The Edit Program screen (ProLink Admin) includes a new section called Eligible Expenses, which includes the Allow Eligible Expenses checkbox. When the checkbox is selected, eligible expense functionality at the application level (such as the Expense menu option and the expense grid on the Edit Program Qualification screen) will be visible.