Working with Common Data Files

Important

ProLink Solutions will update CDF functionality as the U.S. Department of Treasury updates the protocol to support the Homeowner Assistance Fund.

CDF v7.4.1 is the default version in ProLink+.

Important

ProLink+ includes a configuration setting called CDF Expense Support, which allows agencies to send/receive CDF records to/from expense related entities, similar to mortgage servicer entities. The default value is false, where all CDF expense functionality is hidden. If the configuration setting is true, then the agency can queue, export, and import CDF records for eligible expenses.

Common Data File (CDF) protocol provides communication between the Agency and mortgage servicers (or expense provider), ensuring communication is standardized. The two-way protocol covers multiple phases of the homeowner lifecycle, from application through program termination.

The CDF protocol consists of exchange of individual CDF records between the Agency and a mortage servicer (or expense provider).

Each record:

Applies to an individual homeowner mortgage (or eligible expense record)

Applies to a single program offered by the Agency

Has a record type, indicating an action in the CDF process

Includes approximately 138 columns of data per CDF record

CDF records are sent in either comma-separated value (CSV) or Microsoft Excel file format. A single file can contain multiple records for multiple mortgages (or expenses).

CDF files can be delivered either by email or through a secure FTP service, depending on the servicer's (or expense provider's) requirements. And multiple files can be sent or received each day.

CDF protocol adheres to standard process states:

Validation—The servicer confirms the homeowner as part of the program.

Approval—The Agency has given final approval to the homeowner application and is disbursing funds.

Active—Payments are being made on behalf of the homeowner.

Termination—The homeowner is no longer receiving program assistance.

Obstacle—The servicer objects to the homeowner's mortgage participating in the program.

A variety of different record types are exchanged between the Agency and servicers (or expense providers).

Record Type | Direction | Description | About Sending/Receiving the Record Type |

|---|---|---|---|

I Record Initiation | Agency to servicer only |

| Manually queue an I Record when the program advances to Stage 4 - Underwriting. This initiates communication with the servicer about the homeowner application. The Agency should also provide Third Party Authorization forms to the servicer, giving Agency permission to work with the servicer. |

V Record Validation | Servicer to Agency only |

| You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. Update the payment amounts in response to the updated details included in the V Record, such as payment amounts and past due amounts. |

O Record Obstacle | Servicer to Agency only |

| You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. You should determine the servicer's obstacle. For example, if the data is incorrect, you can fix the data and then re-send the I record to restart the process. If the application will not move forward as a result of the obstacle, you should follow the Agency's procedure for denying and inactivating the application. |

A Record Approval | Agency to Servicer only |

| Manually send the A Record when a program advances to Stage 6 - Disbursement. This record tells the servicer that disbursements will begin. Some servicers request 48 hours between an A record and the first disbursement. |

B Record Bulk Payment | Agency to Servicer only |

| A B Record is queued when a disbursement is exported from ProLink+ and a Payment Reference Number and Paid Date are entered for the Disbursement record. Use the Disbursement Utility and Disbursement Export History screen to enter the Payment Reference Number and Paid Date. |

P Record Payment Received | Servicer to Agency only |

| The P Record has fields to indicate the payment was too little (shortage) or too much (overage). You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. |

E Record Payment Change | Servicer to Agency only | Indicates a homeowner's mortgage payment will change | You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. Manually update mortgage payment information in ProLink+ and update any pending disbursements as needed. |

W Record Hard Stop | Servicer to Agency only | Tells the Agency to stop all processing for the homeowner application. | You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. You may need to stop further disbursements from processing by canceling or recycling them, or by advancing the program out of Disbursement. |

T Record Termination | Agency to Servicer only |

| Manually queue a T Record no later than when the program advances to Stage 7 - Monitoring or seven days after the last payment. |

C Record Change | Servicer to Agency only | Indicates a change to a previous record | C Record intent is vague and must be handled manually. You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. |

D Record Denial | Agency to servicer only |

| Manually queue a D Record when an application is denied or inactivated. You must select a Reason for Denial or Termination when inactivating a homeowner application that uses CDF. |

Q Record Requote | Agency to servicer only | Used to request an updated reinstatement payment quote | Manually queue Q Records. If an outstanding Q Record exists for which a Y Record has not yet been received, do not send another Q Record. |

Y Record Requote Response | Servicer to Agency only |

| You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. You might need to update the one-time catchup-payment amount on the Edit Program Qualification screen; or if the program is already in Disbursement, then update the actual Disbursement record that will be making the payment. |

G Record Guaranteeing Funds | Agency to Servicer only | Sent to guarantee a future payment | Manually queue G records. When you queue a G record, the record is populated with the following information:

|

X Record Expected Payment | Servicer to Agency only |

| You can import the record into ProLink+ and view the data within CDF Records on the Homeowner Application. You will need to manually update the application and program data in ProLink+ if needed as a result of the CDF record. |

The CDF Records screen on a Selected Application lists the CDF records associated to the Homeowner Application that have been imported and that are queued for transfer.

The CDF Records data view provides access to all CDF records across the system and allows you to export queued records.

Tip

Use the CDF Record Aging report to view CDF records that have been sent where a match has not yet been received.

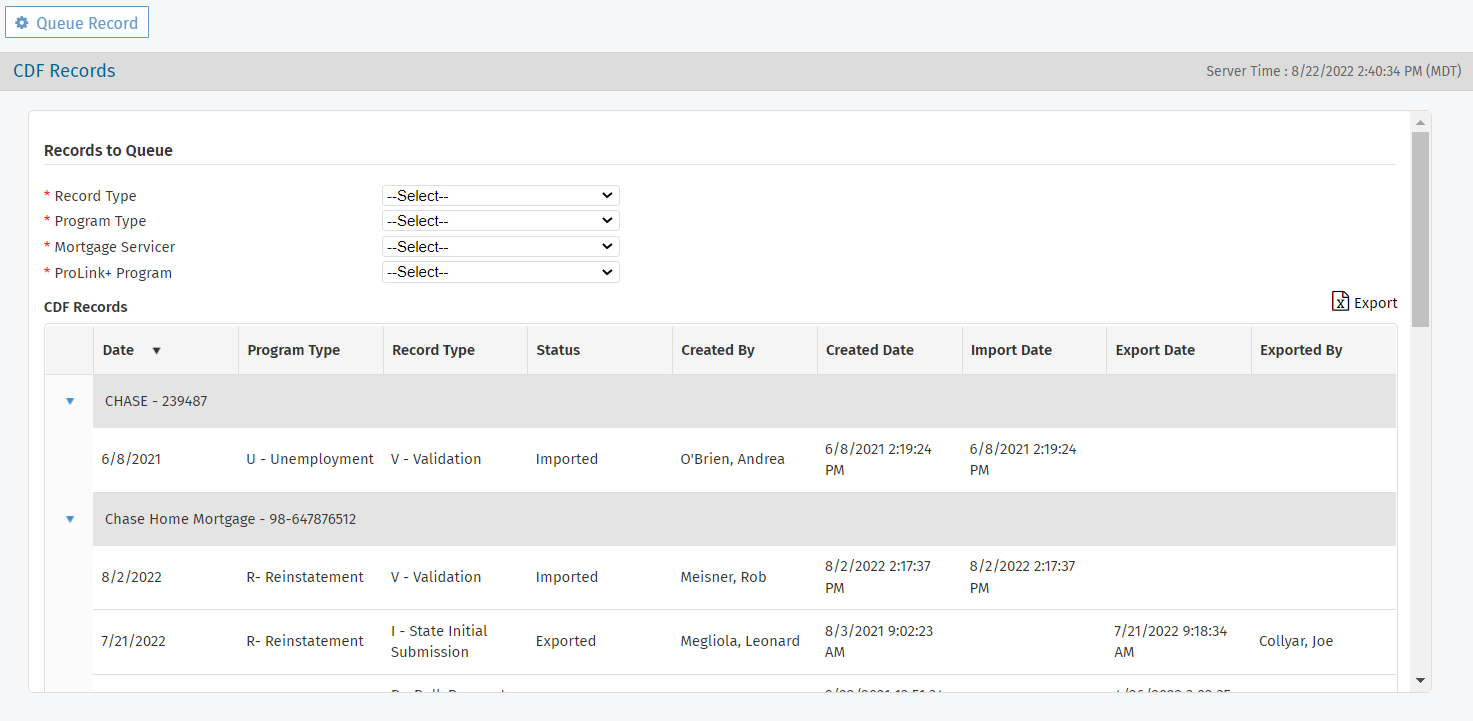

To queue and export CDF records:

Navigate to the application, and then select the CDF Records option in the left navigation menu.

The CDF Records screen opens.

Select the Record Type to queue.

The selected Record Type determines the available Program Types.

Select the Program Type.

Select the Mortgage Servicer to indicate the mortgage to which the queued record should be associated.

Mortgage servicer entities with the Uses CDF checkbox selected on the Edit Entity screen are included in the drop-down list.

When non-B records are queued, the generated CDF record will use data from the selected mortgage instead of the first mortgage. When B records are queued, the generated CDF record will use data from the mortgage associated with the Servicer/Loan Number selected.

If CDF Expense Support is enabled, the field label is Mortgage Servicer/Expense Provider. Expense providers are included in the drop-down list when they are indicated as Eligible on the Edit Expense screen, when the Account Number is not blank, and when the Uses CDF checkbox on the entity record is selected.

If you selected Record Type D or T, then select the Reason for Denial or Termination.

If needed, select the ProLink+ Program from which to pull program-specific information.

If the Homeowner Application includes only one active program, then this field defaults to the active program.

When you select "D - Denial" or "T - Termination" as the Record Type, you can select from both active and inactive programs.

Click Queue Record in the top toolbar.

When you queue a record and the selected entity is an expense provider, the system creates a CDF record for each eligible expense associated to the expense provider with a populated Account Number field.

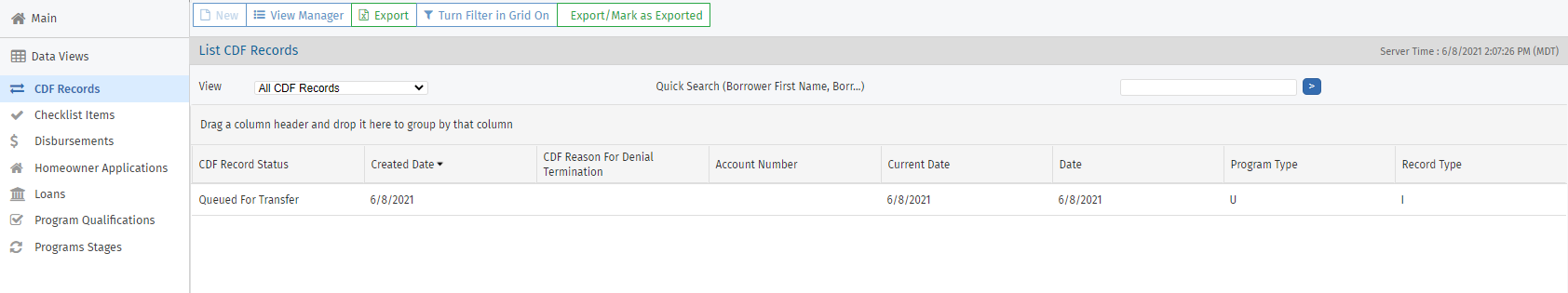

Navigate to the Data Views panel, and then select the CDF Records option in the left navigation menu.

The CDF Records data view opens.

Change the View if needed to view the queued records.

Click Export/Mark and Exported in the top toolbar.

The CDF Record Status for the queued records is changed to Exported, and the Export file is downloaded.

Export Executed Authorization Forms with CDF I Records

You have the option of exporting executed authorization forms when you export CDF I records. The CDF Records spreadsheet and the associated executed authorization forms are included in one .zip file, which the agency can then send to the mortgage servicer.

The system exports executed authorization forms when:

The "EnableCDFAndExecutedAuthorizationFormZipFile" configuration setting is True.

The view selected for the CDF Records screen matches "Queued I Records".

At least one I record with the R program or J program exists.

Each of the following columns is present in the data view for the export: Record Type, Program Type, and Loan Number.

A mortgage (first, second, third, or fourth) in the CDF I record has an associated executed authorization form.

The system finds the associated mortgage for an I record by comparing the Loan Number in column G of the CDF to the Mortgage Loan Number fields on the Homeowner Application - Mortgage Info tab.

The associated executed authorization form is also located on the Homeowner Application - Mortgage Info tab. See Executed Authorization Forms for more information.

Note

The file type for executed authorization forms should be a PDF; otherwise, the log file will record an error.

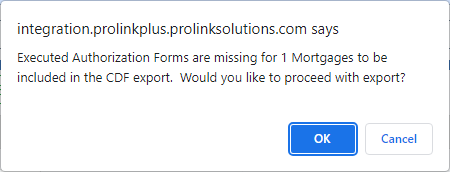

The system will present a message if any mortgages do not have an associated executed authorization form. You can proceed with the export (and only the forms associated to mortgages are included in the .zip file), or you can cancel the export.

On export, the system renames the executed authorization form(s) included in the .zip file using the following format: LOAN[Loan Number]_[State Code]_[CDF Entity Abbreviation]_H.[existing file extension]

The CDF Entity Abbreviation is populated from a new field on the Edit Entity screen for the mortgage servicer entity. See Edit an Entity for more information.

The exported .zip file includes the CDF Records spreadsheet, any associated executed authorization forms, and a text log file that identifies the mortgages in the spreadsheet that have associated executed authorization forms and those that are missing executed authorization forms.

CDF Expense Support

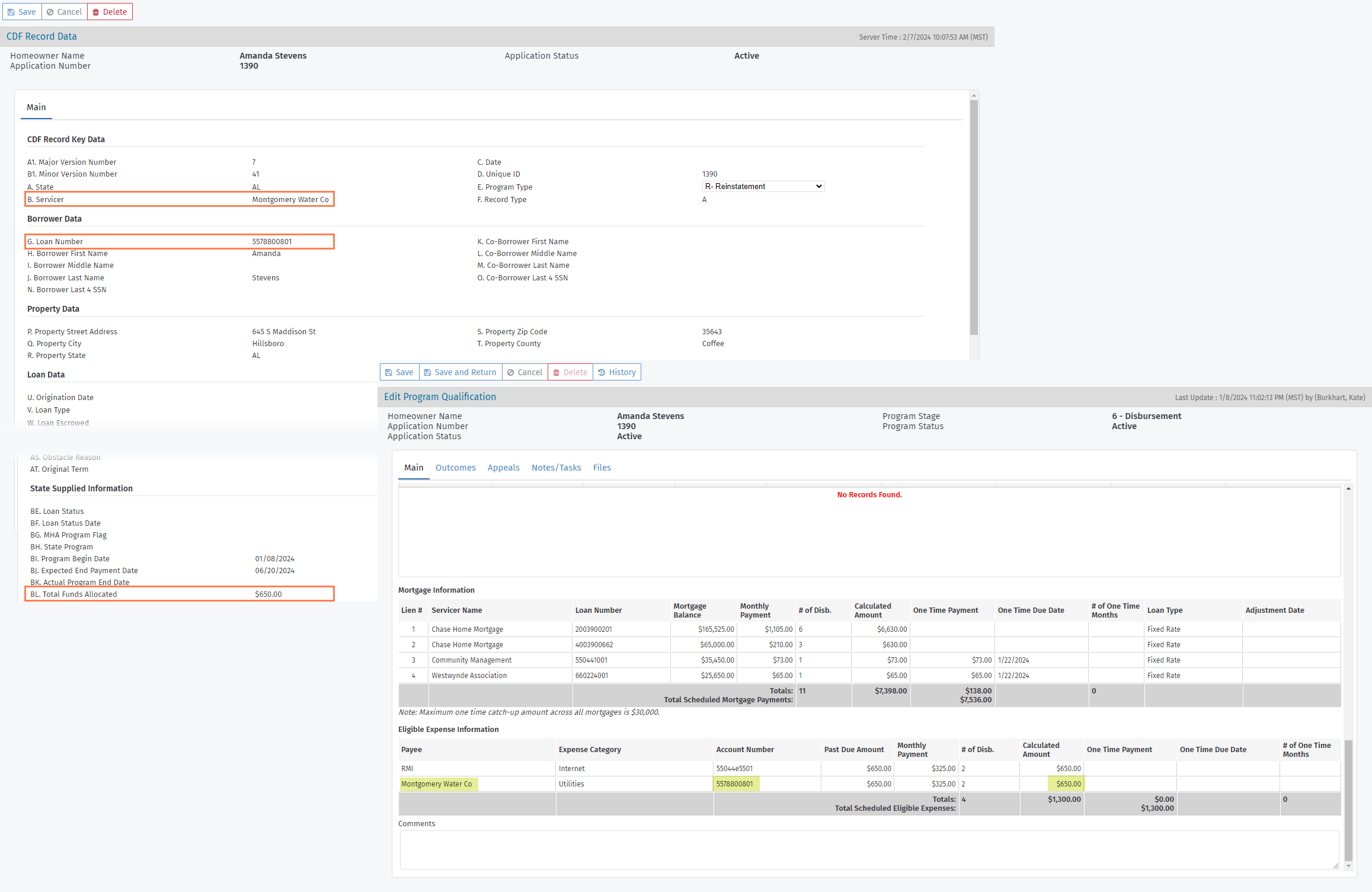

On the CDF Record Data screen, when the entity is an expense provider, the data is mapped as follows:

The B. Servicer field on the CDF Record Data screen will show the name of the entity for the expense.

The G. Loan Number field will show the expense account number.

For record types A, T, and G, the BL. Total Funds Allocated field will show the total eligible expense amount for the specific expense associated to the expense provider (Eligible Expense on the Program Qualification screen).

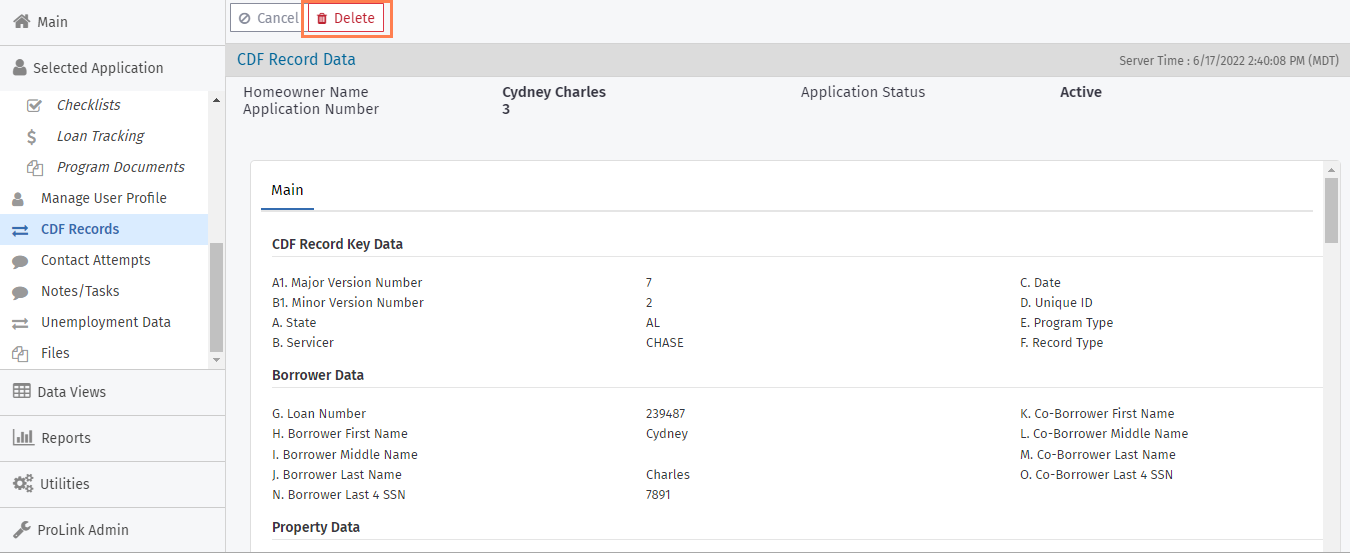

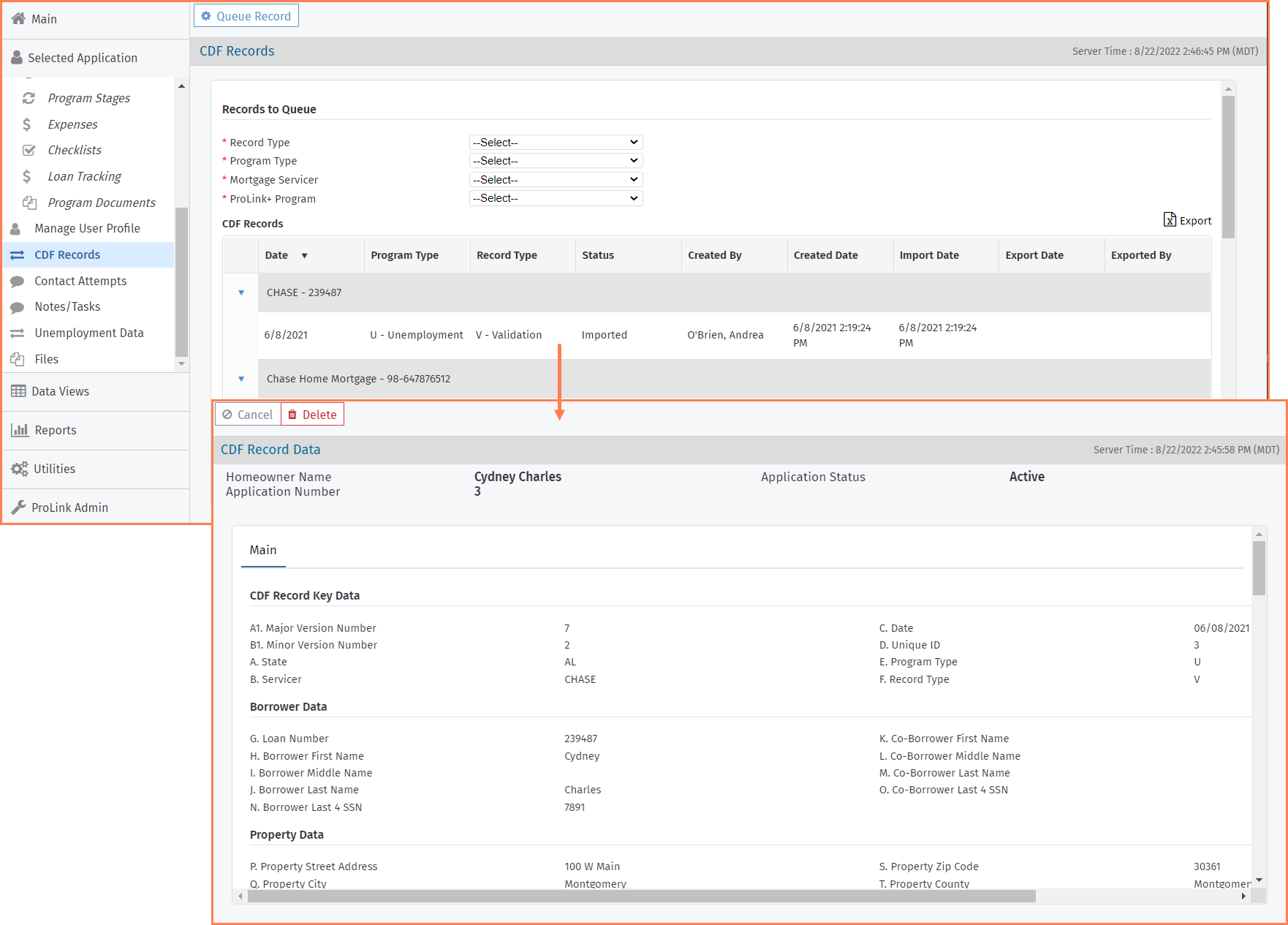

When you import "servicer to state" CDF records through the CDF Import utility, the data is appended to the corresponding Homeowner Application. Navigate to the CDF Records screen to see all of the imported records for the application, and then click a row to open the CDF Record Data screen.

Because multiple mortgages might exist on an application, the system matches imported records to loans based on the Application ID in combination with the Loan Number.

Note

The E. Program Type field on the CDF Record Data screen is a drop-down list that allows you to change the Program Type for an existing CDF record if needed. This functionality is controlled by a security privilege—CDF - Modify Program Type.

Important

Your user security role needs to include the CDF - Delete privilege or the Admin Delete privilege to be able to delete CDF records.

You can delete queued and imported CDF records if needed. You cannot delete exported records. Click Delete in the top toolbar on the CDF Record Data screen to delete the record. You will be prompted to confirm the deletion.