View and Edit Program Qualification Information

An application includes a Program Qualification screen for each applicable program. You cannot edit the Program Qualification information until the program is in stage 2 - Submitted.

Tip

For detailed information about the program requirements for the Homeowner Assistance Fund (HAF), refer to the American Rescue Plan Act of 2021 (ARP) - Section 3206.

Main Tab

The Edit Program Qualification screen - Main tab lists summary information for the program. The Processor/Underwriter uses this screen to specify whether the applicant is eligible for the program, as well as record the Approval date, the Projected Close Date of the loan, and the Disbursement Start Date.

Field | Definition |

|---|---|

Application Benefit Summary | |

Program Name | Displays the program name for the associated program. |

Max Total Assistance per Application | Displays the Maximum Assistance per Homeowner Application from the Edit Fund screen. |

Max Assistance for this Program | Displays the Maximum Allocation per Application from the Edit Program – County Settings tab of the associated program, where the county from the County Settings tab matches the county of the property from the Edit Homeowner Application – Property Info tab. |

Total Approved Amount across Programs | Displays the sum of the Total Approved Amount for programs associated to the application. |

Profile Benefit Summary | |

Max Total Lifetime Assistance | Displays the Maximum Lifetime Benefits per Profile from the Edit Fund screen. |

Total Lifetime Benefits Paid | Displays the sum of paid disbursements for all applications and programs for the profile. |

Max Lifetime Assistance for this Program | Displays the Maximum Lifetime Allocation per Profile from the Edit Program – County Settings tab of the associated program, where the county from the County Settings tab matches the county of the property from the Edit Homeowner Application – Property Info tab. |

Total Lifetime Benefits for this Program | Displays the sum of paid disbursements for all applications for the profile for the same program. |

NoteWhen evaluating the Total Lifetime Benefits per program and Total Lifetime Benefits per applicant/profile, the system uses the Total Approved Amount of other programs in stage <= Stage 6; and the system uses the Total Disbursed Amount of other programs in Stage 7 or 8. The sum of (approved amounts for all programs where Stage <= 6) and (total disbursed net of returns for all programs where Stage >= 7) for all applications under the profile cannot exceed the Max Total Lifetime Assistance. The sum of (approved amounts for the same program where Stage <= 6) and (total disbursed net of returns for the same program where Stage >= 7) for all applications under the profile cannot exceed the Max Lifetime Assistance for the Program. | |

Income Data (Applicant Entered and Underwriter Verified) | |

Applicant Monthly Income | Displays the Total Homeowner Income collected on the application (Financial Info). |

Underwriter Monthly Income | Underwriter Annual Income / 12 |

Applicant Annual Income | Applicant Monthly Income * 12 |

Underwriter Annual Income | Allows the Processor/Underwriter to record the total income based on P/U's verifications. |

Applicant % of AMI | System calculated value (from HUDIncomeLimit table) as follows: Look up the 50% AMI value for the household size (Homeowner Application, Property Info tab, Total Number of Persons Living at this Address) and county (Homeowner Application, Property Info tab, County) with a most recent effective date prior to today's date and multiply by 2 to get 100% AMI value, then take TotalHomeownerMonthlyGrossIncome * 12 divided by the 100% AMI value to get the % of AMI to display. NoteYou can view the Applicant Most Favorable Median Income % through the Homeowner Applications and Program Qualifications data views. This calculated field shows the lesser of the Applicant % of AMI and Applicant % of NMI. |

Underwriter % of AMI | % of AMI using Underwriting Annual Income instead of the Total Annual Income calculated based on applicant input. The Income Limit Effective Date determines which AMI values to use. NoteYou can view the Underwriter Most Favorable Median Income % through the Homeowner Applications and Program Qualifications data views. This calculated field shows the lesser of the Underwriter % of AMI and Underwriter % of NMI. |

Applicant % of NMI | System calculated value (from NationalIncomeLimit table) as follows: Look up the 50% NMI value for the household size (Homeowner Application, Property Info tab, Total Number of Persons Living at this Address) with a most recent effective date prior to today's date and multiply by 2 to get 100% NMI value, then take TotalHomeownerMonthlyGrossIncome * 12 divided by the 100% NMI value to get the % of NMI to display. |

Underwriter % of NMI | % of NMI using Underwriting Annual Income instead of the Total Annual Income calculated based on applicant input. The Income Limit Effective Date determines which NMI values to use. |

Income Limit Effective Date | When application advances to Stage 2 - Submitted, the system populates this field with the current date. |

Income Verification Method | The method used by the Processor/Underwriter to verify income. |

Housing Ratio | |

Underwriter Monthly Housing Expenses | Underwriter-verified monthly housing expenses. Click  |

Underwriter Annual Housing Expenses | Calculated (on save) as Underwriter Monthly Housing Expenses * 12. |

Housing Ratio | Calculated (on save) as Underwriter Monthly Housing Expenses / Underwriter Monthly Income. |

Income Reduction Information | |

NoteThis section is visible when enabled for the program in ProLink Admin. See Programs. | |

Pre-Hardship Annual Income | Field for Processor/Underwriter entry of the applicant's pre-hardship income. |

Post-Hardship-Annual Income | Field for Processor/Underwriter entry of the applicant's post-hardship income. |

Post-Hardship Income Reduction % | Calculated on save to show (Pre-Hardship Annual Income - Post-Hardship Annual Income) / Pre-Hardship Annual Income * 100 |

Socially Disadvantaged Information | Displays read-only fields showing the applicant's answers to the Socially Disadvantaged question and demographics information for applicant, co-borrower, and spouse, if applicable (Personal Information tab on Homeowner Application). NoteThe ProLink Admin Config Settings includes a setting that indicates whether the Socially Disadvantaged question is required to submit the application. In addition, the Homeowner Portal includes a front-end configuration that can hide or show the Socially Disadvantaged question on the application. |

Property Information | |

County | Displays the county of the property address. |

Total Number of Persons Living at this Address | Displays the value collected on the application (Personal Info). |

Last Known Appraisal Value | Displays the value collected on the application (Property Info). |

Current Appraisal Value | Allows the Processor/Underwriter to record the current appraisal value. |

Qualification Information | |

Program Sub-Category | The program's sub-category, if applicable. |

Hardship Reason | The Processor/Underwriter's verification of hardship for the applicant. |

Unemployment Eligibility Status | The Processor/Underwriter's verification of the applicant's unemployment eligibility status. |

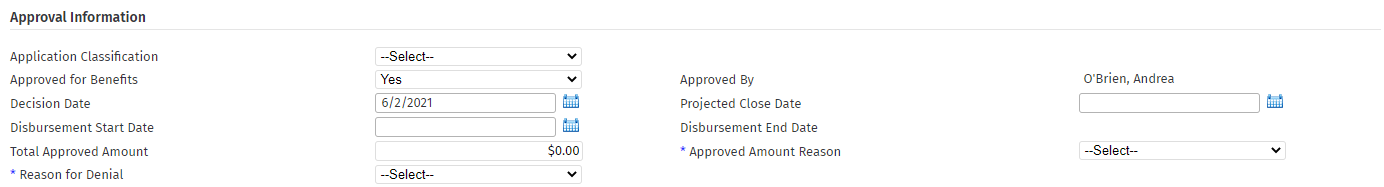

Approval Information | |

Application Classification | The category that applies to the applicant; for example, Income Based, Socially Disadvantaged. The applicant's self-selection of whether they meet the definition of "socially disadvantaged" is recorded on the Property Info tab of the Homeowner Application. |

Approved for Benefits | Yes indicates the applicant qualifies for program benefits; No indicates the applicant does not qualify. |

Approved By | The name of the user that saves the Decision Date entry. |

Decision Date | Required if the Approved for Benefits field is populated. |

Projected Close Date | For loan programs, the planned closing date. |

Disbursement Start Date | The disbursement date range cannot overlap the disbursement date range specified in another program for the same application. This date cannot be before the Actual Close Date. Keep in mind the Actual Close Date is required on the Advance Stage popup when advancing the program to Disbursement. See Program Stages. |

Disbursement End Date | The disbursement date range cannot overlap the disbursement date range specified in another program for the same application. |

Total Approved Amount | Required if the program stage is 5 - Closing or greater. For programs in stages 3 - Qualification, 4 - Underwriting, and 5 - Closing, the Total Approved Amount cannot be less than the Total Scheduled Amount and cannot be greater than the maximum allocation per homeowner for the property county, which is specified on the Edit Program - County Settings tab for the selected program. For programs in stages 6 - Disbursement and 7 - Monitoring, the Total Approved Amount in the Approval Information section cannot be less than the sum of all Disbursed, Pending, and Recycled Disbursements and cannot be greater than the maximum allocation per homeowner for the property county, which is specified on the Edit Program - County Settings tab for the selected program. |

Approved Amount Reason | Required when the Total Approved Amount is not equal to the sum of the Total Scheduled Amount. For programs in stages 3 - Qualification, 4 - Underwriting, and 5 - Closing, if the Total Approved Amount is greater than the Total Scheduled Amount, the Approved Amount Reason field is required. For programs in stages 6 - Disbursement and 7 - Monitoring, if the Total Approved Amount is less than the sum of all Disbursed, Pending, and Recycled Disbursements, the Approved Amount Reason field is required. |

Reason for Denial | Required if No is selected for the Approved for Benefits field. |

Total Scheduled Amount | Sum of Total Scheduled Mortgage Payments and Total Scheduled Eligible Expenses. |

CDF Information | |

NoteThis section is visible when enabled for the program in ProLink Admin. See Programs. The grid shows information from received CDF C, V, and Y records to help you confirm payment amounts. Click a row in the grid to navigate to the CDF Record Data screen for the record. | |

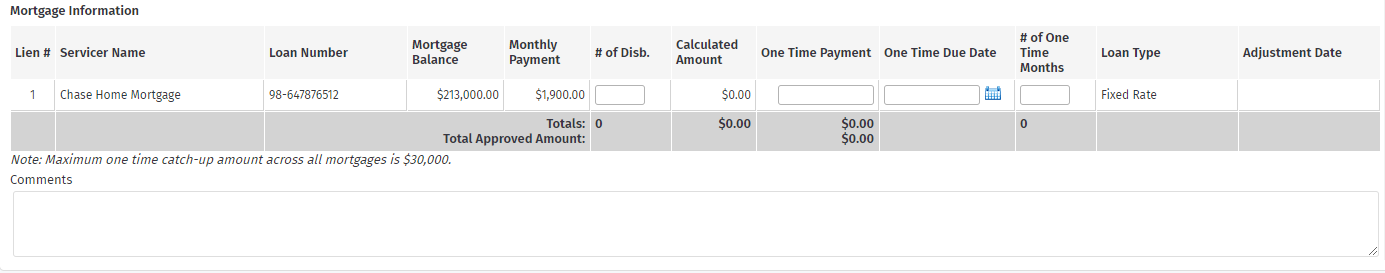

Mortgage Information | |

Lien # | Displays the number of the mortgage from the list collected on the application (Mortgage Info). |

Mortgage Balance | Displays the mortgage balance amount collected on the application (Mortgage Info). |

Monthly Payment | Displays the mortgage payment amount collected on the application (Mortgage Info). |

# of Disb. | The number of scheduled disbursements. |

Calculated Amount | Monthly Payment * Number of Disbursements |

One Time Payment | The catch-up payment amount. The maximum one time catch-up amount across all mortgages is the amount set by the Agency for the county (ProLink Admin). Any One Time Payment counts as only one disbursement when calculating total number of disbursements regardless of the number of months that the catch up payment covers. |

One Time Due Date | The due date of the catch-up payment. |

# of One Time Months | The number of months that the catch-up payment covers for the homeowner. |

Loan Type | Displays the mortgage loan type collected on the application (Mortgage Info). |

Adjustment Date | Displays the mortgage adjustment date (date of rate change for an adjustable rate loan) collected on the application (Mortgage Info). |

Total Scheduled Mortgage Payments | Sum of the total Calculated Amounts and total One Time Payments. For programs in stage 5 - Closing or earlier, the total approved amount cannot exceed the maximum allocation per homeowner for the property county, which is specified on the Edit Program - County Settings tab for the selected program. |

Eligible Expense Information | |

NoteThis section displays the expenses that have been flagged as eligible, when the program has been configured for expenses. | |

Payee | Displays the name of the expense entity (Edit Expense). |

Expense Category | Displays the expense category (Edit Expense). |

Account Number | Displays the applicant's account number with the expense entity (Edit Expense). |

Past Due Amount | Displays any past amount due for the account (Edit Expense). |

Monthly Payment | Displays the applicant's monthly payment amount on the account (Edit Expense). |

# of Disb. | The number of scheduled disbursements. |

Calculated Amount | Monthly Payment * Number of Disbursements |

One Time Payment | The catch-up payment amount. Any One Time Payment counts as only one disbursement when calculating total number of disbursements regardless of the number of months that the catch up payment covers. |

One Time Due Date | The due date of the catch-up payment. |

# of One Time Months | The number of months that the catch-up payment covers for the homeowner. |

Total Scheduled Eligible Expenses | Sum of the total Calculated Amounts and total One Time Payments. |

Approve or Decline Benefits for an Applicant

If the applicant qualifies for program benefits:

Select the appropriate Application Classification for the applicant.

Select Yes in the Approved for Benefits list.

Enter the Decision Date. The Approved By field is automatically populated with your name.

Enter the Projected Close Date of the loan, if applicable.

Enter the date of the first disbursement in the Disbursement Start Date.

Click Save.

If the applicant does not qualify for program benefits:

Select No in the Approved for Benefits list.

Enter the Decision Date. The Approved By field is automatically populated with your name.

Select the Reason for Denial.

Click Save.

More about the Mortgage Information

The Mortgage Information section lists all servicers that were selected on the Mortgage Info tab of the application. When the application is advanced to the Disbursement stage, a disbursement schedule based on the information in the Mortgage Information section is automatically created with the disbursements specified, starting at the Disbursement Start Date or the One Time Payment Due Date.

For each servicer, the Servicer Name, Loan Number, Mortgage Balance, and Monthly Payment are displayed from the Mortgage Info tab of the application.

For each servicer to be disbursed to, enter the number of months in the # of Disb. field to calculate the total approved amount the applicant will receive.

If the mortgage is delinquent and a one-time payment must be made to bring it current, enter the amount of the one-time payment in the One Time Payment field for the servicer. Then specify the One Time Due Date. Specify the number of months the one-time payment is intended to catch up the mortgage for.

Caution

For programs in stage 5 - Closing or earlier, the total approved amount cannot exceed the maximum allocation per homeowner for the property county, which is specified on the Edit Program - County Settings tab for the selected program.

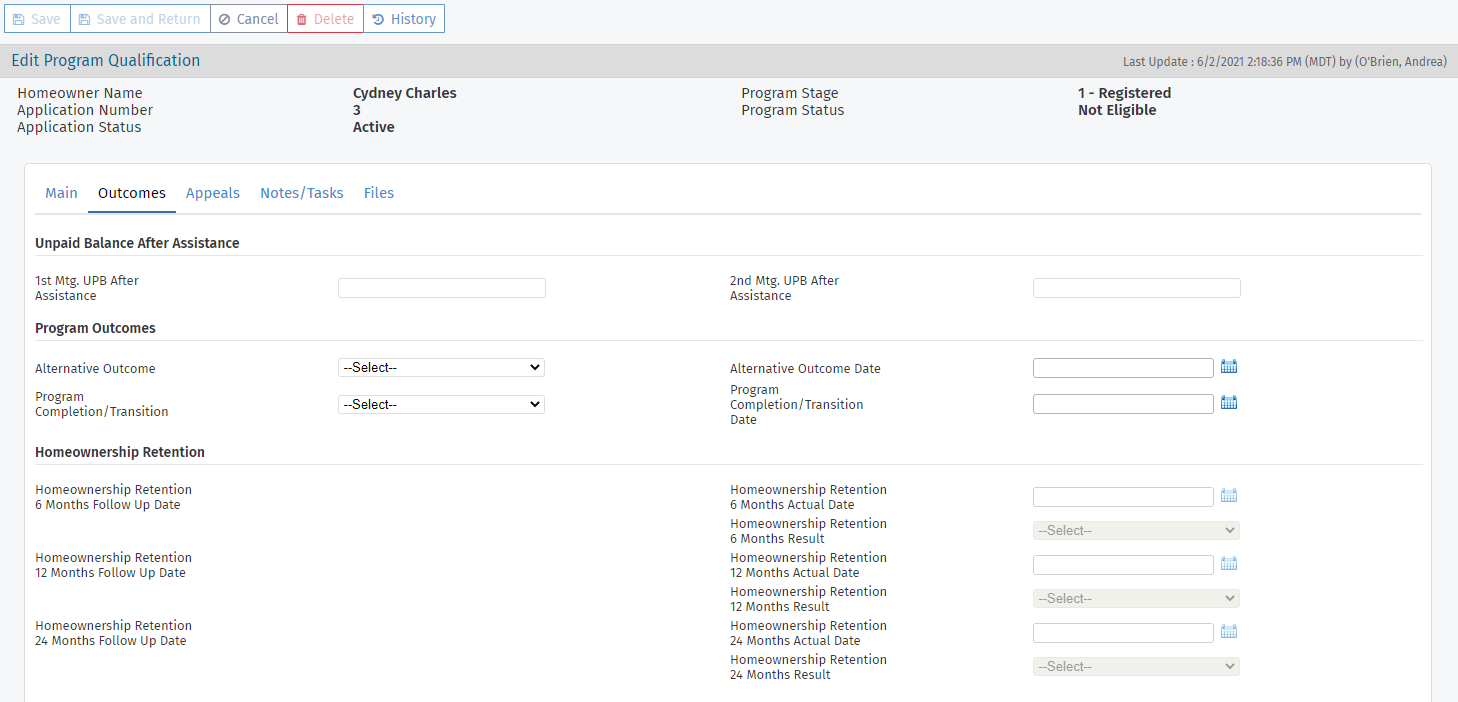

Outcomes Tab

The Outcomes tab allows you to record information about the outcome of the assistance and the home retention information for the U.S. Department of the Treasury.

The Homeownership Retention 6 Months Follow Up Date is equal to the Paid Date plus six months for the earliest Disbursement Paid Date with a status of Disbursed.

The Homeownership Retention 12 Months Follow Up Date is equal to the Paid Date plus 12 months for the earliest Disbursement Paid Date with a status of Disbursed.

The Homeownership Retention 24 Months Follow Up Date is equal to the Paid Date plus 24 months for the earliest Disbursement Paid Date with a status of Disbursed.

Tip

View the Homeownership Retention Follow Up Status for all programs across the system through the Program Manager Overview.

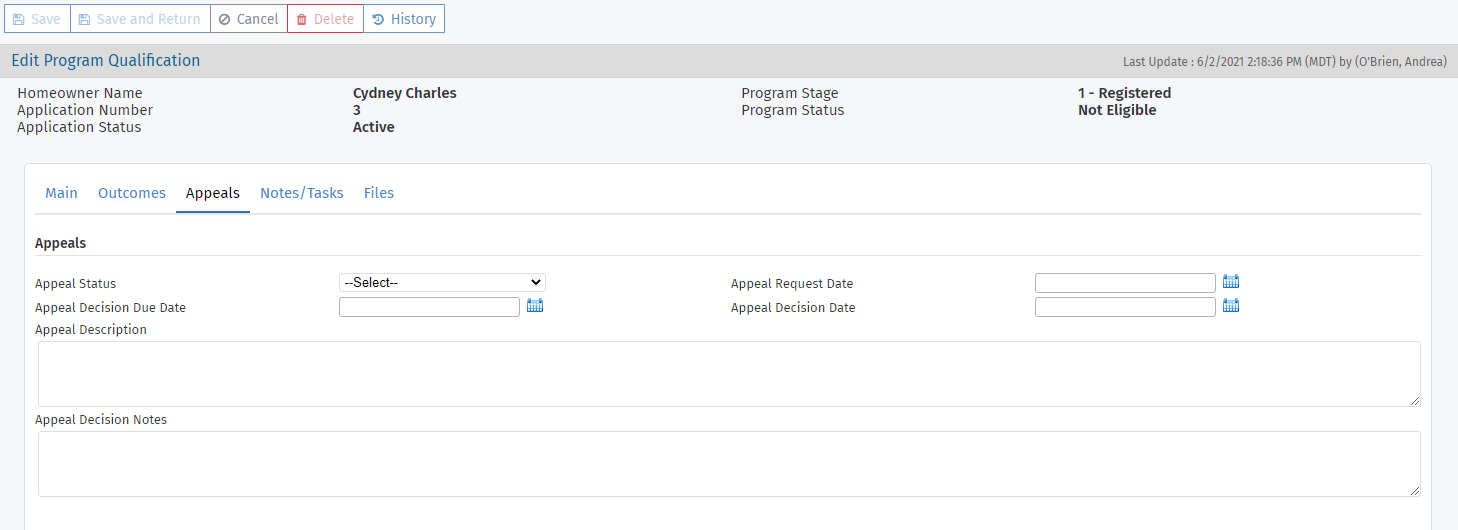

Appeals Tab

The Appeals tab provides a location for tracking appeals on the program decision. While none of the fields are required, we recommend recording as much information as possible to maintain an accurate history of the appeal and report on it as needed.